Bitcoin is back with a bang. What’s ahead?

This week’s stellar market momentum has largely been tied to enthusiasm around the possible approval of a spot Bitcoin ETF.

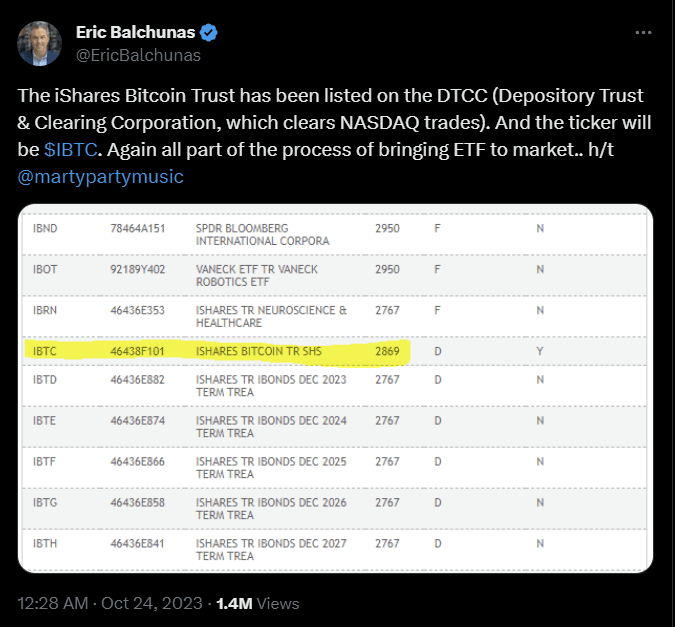

On Monday, the hopeful arrival of spot BTC ETF approval became more apparent after a string of bullish developments. Scott Johnsson, a General Partner at Van Buren Capital, noted that recent BlackRock regulatory filings revealed the asset manager had already received a Committee on Uniform Securities Identification Procedures (CUSIP) number for its spot BTC ETF and could begin “seeding” the ETF as early as this month. Later on Tuesday, this tweet happened.

Source: X (Twitter)

Many industry observers saw the initial inclusion of BlackRock's iShares Bitcoin Trust fund on the list as a possible indication that approval from the US SEC may be getting closer. And Bitcoin zoomed!

It’s not often that we see Bitcoin increase by $5,000 in a day. Some were caught off-guard.

Source: Twitter

What’s in store in the upcoming two months? Let us identify some trends.

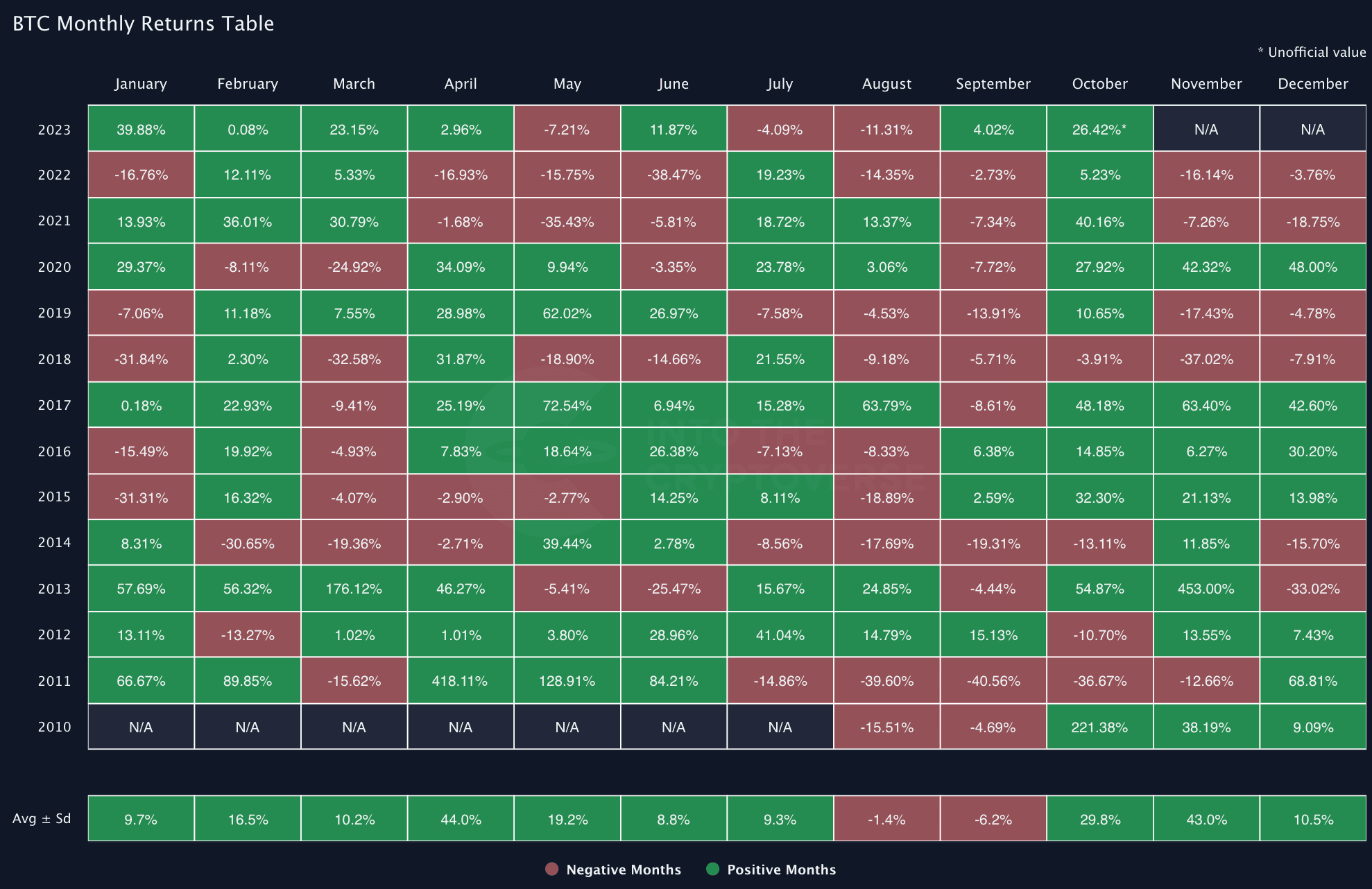

Historical monthly returns suggest a mixed end

While September is usually pretty gloomy for Bitcoin, October has been a torchbearer.

What about November? Four of the last five years have registered a red in November – same in December; although the approval of a Bitcoin Spot ETF can change things dramatically. If that is pushed to the new year, however, we anticipate that Bitcoin goes back to its previous levels ~$30,000 in the next two months as we wait it out. That will be an ideal time to enter some positions for the long term too.

Bitcoin Monthly Returns. Source: Into the Cryptoverse

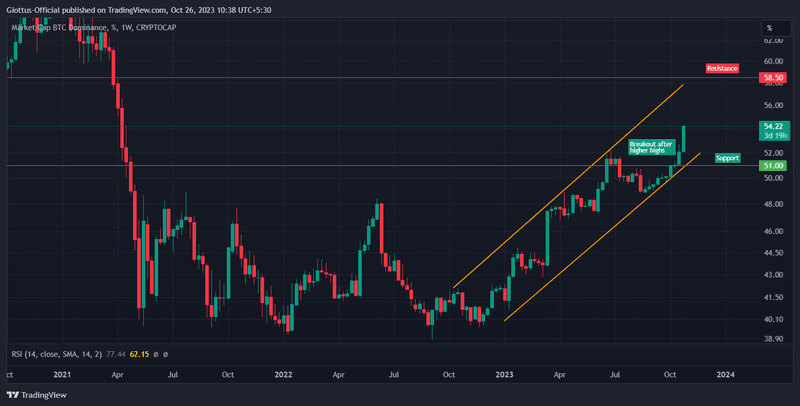

Market dominance has broken out

Bitcoin is well positioned to outperform the market in the next six months. From the chart below, we can deduce that Bitcoin is well set to take out 58% market dominance (next major resistance). However, Bitcoin will eventually hit a ceiling in terms of dominance (at 60% or higher), and altcoins will shine as money will rotate and spill over to them.

Bitcoin Market Dominance. Source: Trading View

New highs are not yet in for total market cap

The moves in the crypto space past week were heavily triggered by rotation of capital within the arena. While Bitcoin has put in a yearly high (and beat the previous one by more than 10%), the total crypto market cap is still under the same resistance it touched in April this year. This means that new capital has not yet flown into the market yet. That will happen if spot ETF is approved.

Source: Trading View

January returns usually sets the tone for the year

Months have had significance in traditional equity markets. January’s performance often predicts the rest of the year. If January is a green month for the S&P 500, the rest of the year tends to be green as well (about 70% of the time). In recent years this has applied for Bitcoin as well. In 2023, we witnessed BTC closing at 40% in January and have so far performed pretty good with returns at 69% in past year.

This means that January 2024 is a key indicator of start of the next bull run. 2024, with Bitcoin halving and more regulatory clarity, is already looking a winner. The question is around the quantum of such gains.

Beware of a recession

While things look rosy in isolation, the scare of a recession in the US and in major markets is real. Crypto assets can drop 30-40% in no time if such a scare eventuates. So far, the likelihood of a recession in 2023 is minimal. We might get the confirmation just before the halving in April 2024. The best way to deal with this is to have some share of your capital in liquid assets like cash/deposits to capitalise if this materialises.

Key Takeaway

Right now, Bitcoin needs to break above $36,000 to continue its uptrend. That is not an easy ask considering it pumped 30% in the past two weeks. A pullback here is more likely and a breakout could happen once the spot ETF rumours crystalize into concrete action. Meanwhile, we advise our readers to stay put and buy the dip if Bitcoin slumps below $30,000 by end of the year. Avoid altcoins till BTC dominance hits a clear high.

Not subscribed to Cryptogram yet? Subscribe here

Disclaimer: Crypto-asset or VDA investments are subject to market risks such as volatility and have no guaranteed returns. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 11th November, 2025 9:25 AM