Ethereum just broke above $3,000 this week and has rallied nearly 30% in February so far. This is the biggest monthly gain since April 2022 – just before the LUNA crash happened.

This surge comes amidst a mixed performance in the broader crypto market, highlighting Ethereum's resilience and growing investor confidence. Analysts are buzzing with optimism, predicting further rallies that could see Ethereum breaking new barriers.

Let us discover key trends that are driving this price rise.

- ETH/BTC pair is showing strength

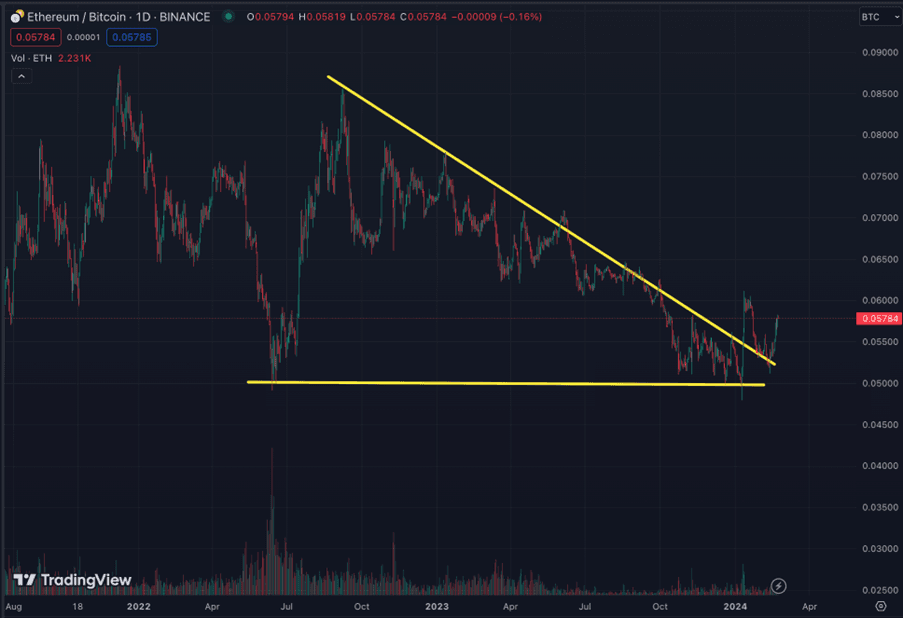

After months of breaking down on its ETH/BTC pair, Ethereum finally showed strength around its 0.05 valuation and zoomed ahead once the Bitcoin spot ETF approvals kicked in. It broke its declining trendline and has successfully done a retest of it as support. Now, its surging ahead with 0.06 as the immediate target.

ETH/BTC pair bounced off its declining trendline. Source: TradingView

- Open interest crossed the $1 billion mark briefly

Ethereum briefly crossed $1 billion in CME futures open interest, a level not observed in over two years. The surge in open interest for Ethereum CME futures occurred shortly after Franklin Templeton announced their application for a spot Ethereum ETF.

Source: Ethereum Open Interests - CME

This application places Franklin Templeton among other notable firms such as BlackRock, Fidelitfy, Ark 21Shares, Grayscale, VanEck, Invesco, Galaxy, and Hashdex, all of whom have submitted similar applications in recent months.

- There is an inherent, well-designed supply crunch

Since January, Ethereum's on-chain activity witnessed a significant surge, leading to nearly $270 million worth of ETH being burned. This has reduced the circulating supply to a new low post its merge. This comes after the Ethereum network's Shanghai upgrade transition to Proof-of-Stake, which notably decreased new ETH issuance by about 90%. Despite over 1.05 million ETH being rewarded to stakers since the upgrade, the burn mechanism has permanently removed over 1.4 million ETH from circulation.

This reduction in supply, coupled with sustained or growing network utilization, underscores Ethereum's expanding adoption and utility across various applications. From an investment perspective, the increased burn rate may herald appreciating value for ETH holders, assuming demand trends remain positive. This dynamic interplay between supply scarcity, network activity, and market demand forms a foundational pillar for Ethereum's economic model and its future trajectory.

- Staked ETH volume continues to grow

A total of 30 million ETH or 25% of its supply of 125 million is currently being staked in protocols such as Lido which offers in exchange its liquid staked token (LST) called stETH. This token generates a 3-6% yield as a reward for securing the ETH network via the PoS mechanism.

Since late 2023, new protocols have emerged that are also building on top of Lido and stETH locking-up even more Ethereum from its liquid supply. Some of this took the form of re-staking and users are incentivized to do it since they get yields from other protocols besides Ethereum. EigenLayer raised billions in staked ETH thanks to incentives. Staking ETH ensures that available ETH for trading is reduced significantly.

Source: DefiLlama

- Dencun upgrade is near

Ethereum's long-awaited Dencun upgrade is set for mainnet deployment on March 13 after passing its final testnet dress rehearsal earlier this month. Dencun is set to drive down the costs of transacting on Ethereum, especially on Layer 2, by replacing call data with Binary Large Objects (blobs). Duncan upgrade along with ETH based spot ETFs are driving the key narrative for Ethereum adoption in the short-term.

What does it mean for you, the investor?

Bitcoin needs to rally about 17% more to hit its all-time high whereas Ethereum needs about 50% - this is a clear indication that ETH has potential to outperform Bitcoin in the bull market. The narratives are driving demand and adoption for the #2 crypto asset currently. While it is not immune to larger crypto market downturns, ETH is often the leader when it comes to altcoin performance. Having a major portion of your crypto portfolio in ETH is not a bad idea.

Not subscribed to Cryptogram yet? Subscribe here

Disclaimer: Crypto-asset or VDA investments are subject to market risks such as volatility and have no guaranteed returns. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.