Will the halving drive retail adoption for Bitcoin?

The halving event – in approx. 9 days – will reduce the rate of new Bitcoin issuance to 3.125 BTC per block from 6.25 BTC. Historically, they have been followed by continued bullish momentum sustaining for a year or more. However, this year presents an unique situation, with the markets rising under the influence of spot ETFs while grappling with unfavourable macroeconomic conditions. Let's analyse the trends.

- Rough macro conditions

The US interest rate has risen at a meteoric rate, with Washington Post comparing their surge unmatched to Rockettes, the OG dance group. With interest rates at their highest in 23 years and many people worried about a recession, it's clear that we are in a unique economic situation. When the global economy gets worse, people usually sell risky assets. It's important to note that Bitcoin hasn’t been through a global recession, yet.

Source: Financial Times

- Heightened institutional involvement

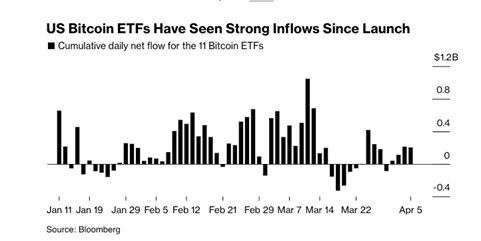

The introduction of Bitcoin ETFs has definitely affected how money moves around in this cycle. ETFs make it simpler for retail investors and big organizations to invest in Bitcoin. Its widespread adoption could make the market hit new highs while the downward volatility is limited.

- An early peak this cycle?

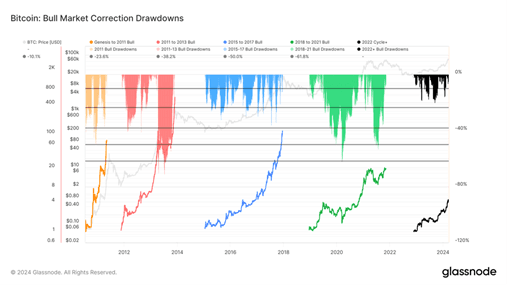

Historically, previous cycles have witnessed significant corrections ranging from 30-40% on the journey towards all-time highs. However, in the current cycle, downturns have been comparatively less volatile, with corrections not exceeding 25% thus far. This persistent trend of predominantly upward movement has led many to speculate that Bitcoin is progressing through this cycle at an accelerated pace, implying that we may see the peak arriving sooner than expected.

Source: Glassnode

The right time to buy BTC is…

In our opinion, there are two buying opportunities.

- Buy the Dip

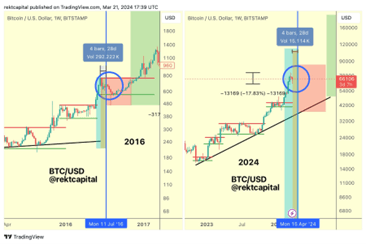

Investors can do well to identify market dips (different from market downtrend). With the market currently already on a upward trajectory, we believe that any course correction from here until halving is unlikely. But opportunities can arise in the next 2 months. After the record high on March 14, BTC fell 18% by March 19. It subsequently recovered until the next dip occurred on April 2. We believe that any dip below $65,000 are excellent entry points.

- Re-Accumulation phase post halving

In simpler terms, this is ideally the time, when price moves sideways post halving. This is typically the silent phase of the cycle before the price trajectory goes on a parabolic rise. During the 2nd halving in 2016, we noticed considerable drawdowns followed by subsequently recovery, that proved to be good entry points.

Key takeaway

Bitcoin halving is ahead and we usually observe that retail adoption follows a few months hence. Analysts expect Bitcoin to reach $100,000 sometime in 2024. While Bitcoin will lead the market first, altcoins will likely outperform Bitcoin in the later part of 2024. Identifying the correct dip opportunity and the phase to invest in is ideal for all crypto investors who have capital to allocate. Regular cost averaging is also a worry-free way to approach the market.

Not subscribed to Cryptogram yet? Subscribe here

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 8th December, 2025 2:37 PM