Bitcoin or Gold? Maybe both!

For years, Bitcoin and gold have been viewed as two distinct and often opposing forces in the world of investing. Bitcoin, the decentralized digital currency, has been touted as the "digital gold" of the 21st century - a modern store of value poised to revolutionize wealth preservation.

Gold, with its centuries-old reputation as a safe-haven asset, has long been the go-to choice for investors seeking stability in times of economic volatility. In the past, Bitcoin's explosive price surges often came at the expense of gold, with Bitcoin’s value increasing while gold's remained relatively stable.

However, recent trends suggest a shift in the financial landscape, where both Bitcoin and gold are gaining traction simultaneously. This new dynamic points to a possible evolution in the asset class hierarchy, where both traditional and digital assets thrive together. In this edition, we explore how this shift could reshape the investment landscape and whether Bitcoin and gold are set to become the cornerstone of future portfolios.

Bitcoin vs. Gold: Power dynamics

Since Bitcoin’s creation, its price surges have often led to a decline in gold's value relative to the cryptocurrency. As seen in data from Ecoinometrics, the gap between Bitcoin and gold has been widening over time. In 2011, just one Bitcoin could buy about 0.9 ounces of gold. Fast forward to 2017, that ratio had jumped to 11 ounces per Bitcoin, a massive leap as Bitcoin’s price skyrocketed while gold remained mostly stagnant.

By 2021, the gap had widened even further, with one Bitcoin purchasing 34 ounces of gold, as Bitcoin’s price hit $69,000 and gold stayed around $1,800 per ounce. At that point, Bitcoin seemed to outpace gold in the race for asset supremacy, with many viewing it as the future of wealth storage, especially in a world increasingly sceptical of traditional financial assets.

Bitcoin's growing appeal, fuelled by its capped supply of 21 million coins, made it an attractive option for investors seeking a hedge against inflation and centralized financial control. Meanwhile, gold found it difficult to compete with Bitcoin’s narrative and its price performance during these periods of crypto euphoria.

However, Gold has proved its worth in 2025

Despite Bitcoin’s rise, gold has had a remarkable year in 2025. It has found new strength, driven by factors like central bank buying, especially from countries such as China and Russia, looking to hedge against a weakening US dollar. Gold’s status as a safe-haven asset has been reinforced by ongoing inflation concerns, which have kept it attractive to investors seeking stability in uncertain times.

Unlike previous bull runs, where Bitcoin often overshadowed gold, this time both assets are climbing, each for its own reasons. Gold is benefiting from global demand for safety, driven by geopolitical tensions and the ongoing trend of de-dollarization

Source: Ecoinmetrics on X

Central Banks are stockpiling Gold; while institutions are shifting towards Bitcoin

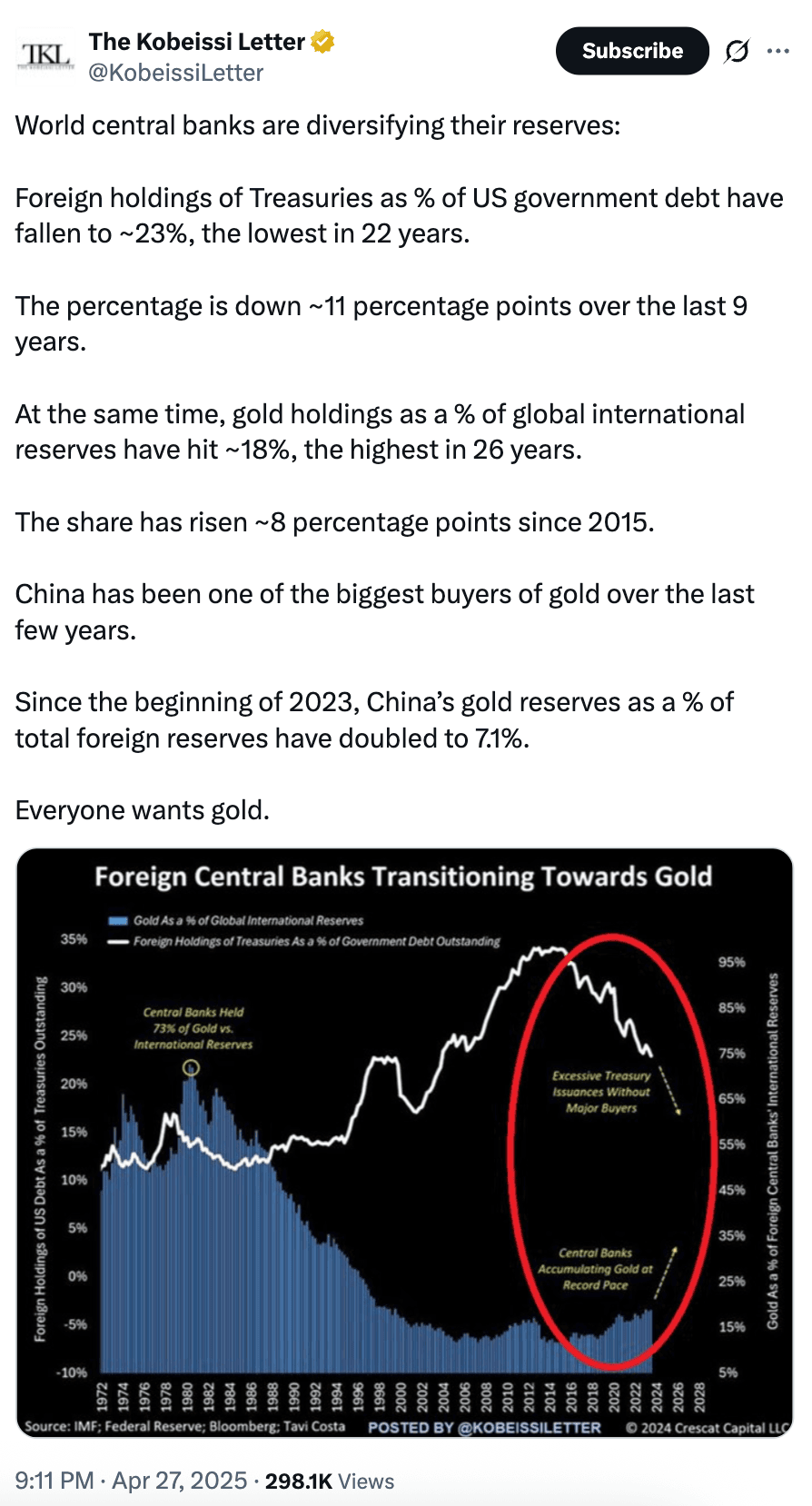

Recent data highlights a significant shift in global reserve strategies. According to The Kobeissi Letter and TaviCosta, central bank gold purchases remain at historically strong levels, with gold holdings now making up about 18% of global reserves - the highest in 26 years. At the same time, foreign holdings of US Treasuries have dropped to around 23% of total US government debt, the lowest in two decades.

This movement away from US Treasuries and toward gold as a reserve asset signals a potential shift in the global financial landscape. As central banks diversify away from US debt, it could lead to increased volatility in the bond market and higher demand for gold.

Source: The Kobeissi Letter in X

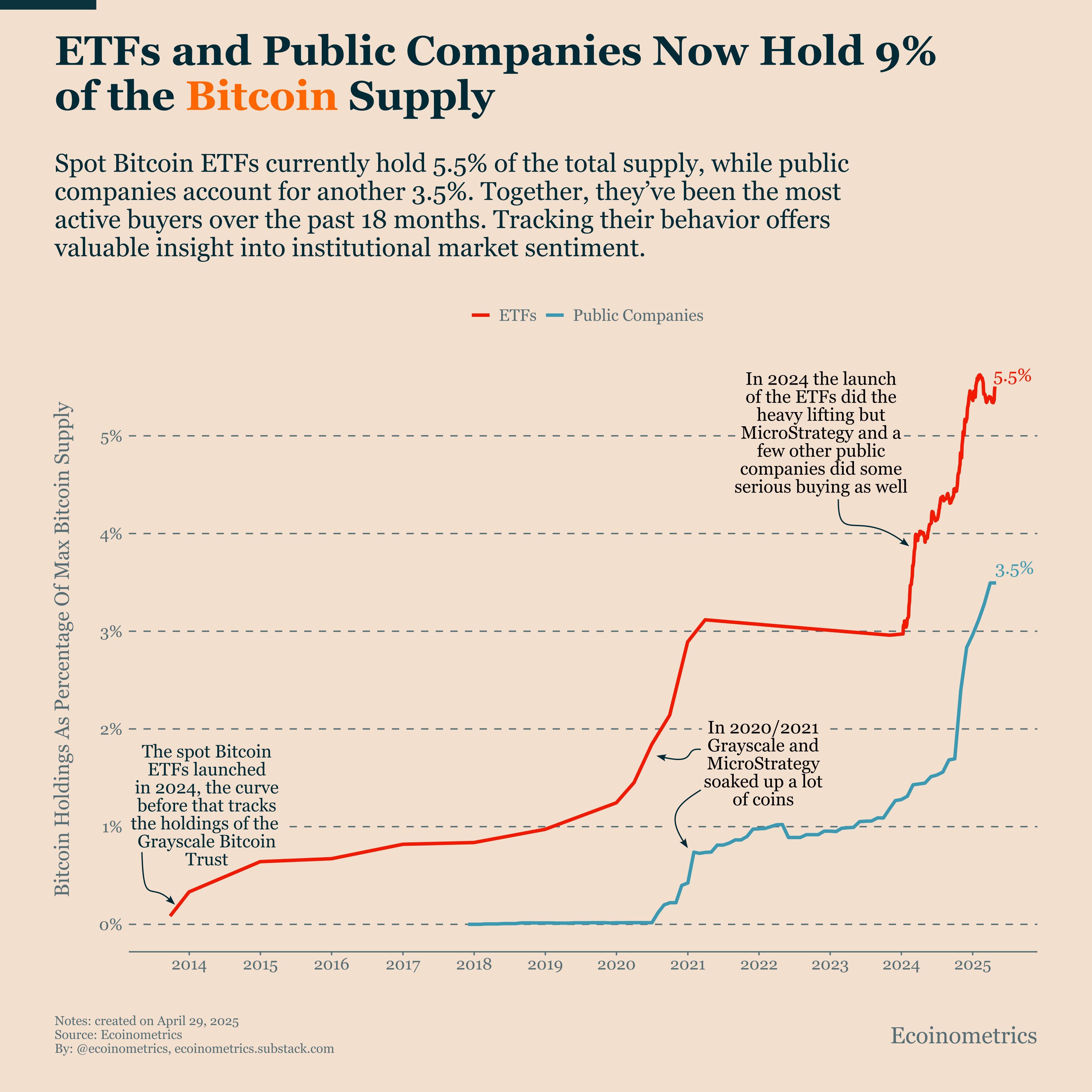

Meanwhile, according to the latest data from Ecoinometrics, spot Bitcoin ETFs now hold a staggering 5.5% of the total Bitcoin supply - just one year after their launch in 2024. Public companies, led by Strategy and joined by an expanding group of corporate buyers, account for another 3.5%. Together, these two groups now control 9% of Bitcoin’s maximum supply.

Source: Ecoinmetrics on X

Bitcoin ETF outpaces GLD gold ETF

This year, gold has outperformed Bitcoin, with the precious metal up by 33% while Bitcoin has only gained 6.4% year-to-date. Yet, there’s a fascinating shift happening behind the scenes: investors are pouring money into Bitcoin ETFs at an unprecedented rate. As Split Capital points out, BlackRock’s Bitcoin ETF has seen more inflows this year than the popular GLD gold ETF.

Source: Split Capital on X

This shift indicates that rather than chasing the better-performing store of value in 2025, investors are positioning themselves for what’s about to come. With more capital flowing into Bitcoin, it’s clear that many are betting on the future potential of Bitcoin, believing that it will ultimately overtake gold in the race for hard asset supremacy.

Morgan Stanley sees Bitcoin as a strategic asset

Recently, Morgan Stanley made a bold statement in one of their reports: Bitcoin is now large enough to be considered a national strategic reserve asset. This is a significant development, but what's even more important is what was left unsaid. Behind the scenes, a larger shift is underway, as global economies search for a neutral asset to settle trades. In this context, Bitcoin’s growing stature could give it a critical edge in securing financial systems, especially as the U.S. explores alternatives to traditional gold reserves.

Bitcoin’s decoupling: A positive for diversified portfolios

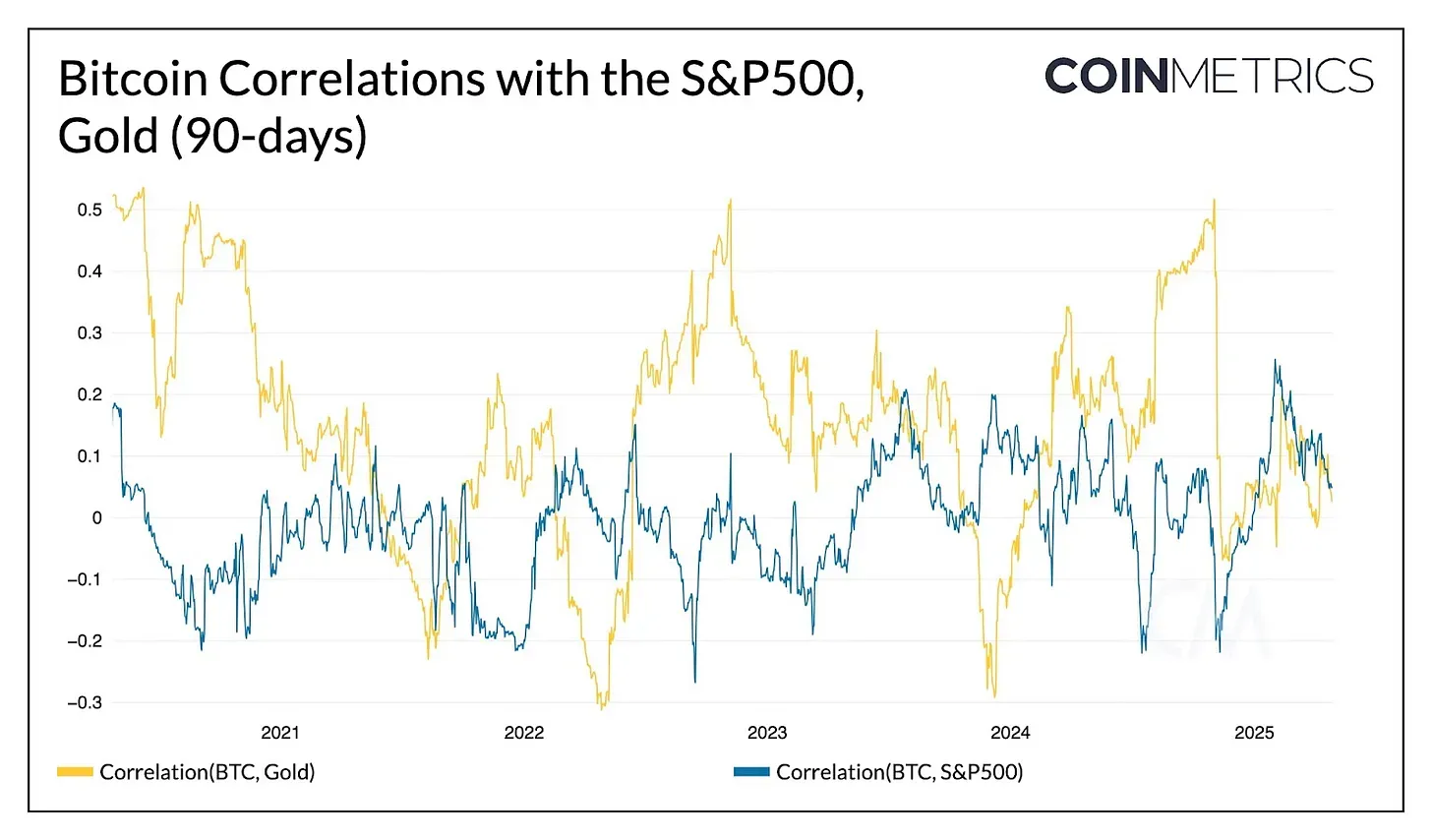

Bitcoin is showing signs of decoupling from both traditional equities and gold, marking a shift in its market behavior. Data from Coin Metrics reveals that Bitcoin’s 90-day correlation with both the S&P 500 and gold has been historically low in recent months. While Bitcoin typically fluctuates between being more correlated with gold or stocks, it’s been trending toward zero correlation with both since February 2025, a pattern not seen since late 2021.

Source: Coinmetrics Charting Tool

Periods of low correlation often follow significant events or shocks in the crypto market, such as the China Bitcoin ban and the spot Bitcoin ETF approval. Interestingly, these low correlation phases have historically been followed by moderately positive returns for Bitcoin. This decoupling trend suggests that Bitcoin is gaining a more independent market profile, making it a valuable asset for risk-diversified portfolios looking for less correlation with traditional markets.

Key Takeaway: A Balanced Future for Gold and Bitcoin

As we move further into 2025, both Bitcoin and gold are proving to be strong contenders for investors seeking stability and growth. While gold remains a key safe-haven asset, bolstered by central bank buying and geopolitical uncertainties, Bitcoin is increasingly seen as a strategic asset, with growing institutional interest and its decoupling from traditional markets.

The shift in global reserve strategies, alongside Bitcoin’s rising role in diversified portfolios, signals that both assets have their place in the future of wealth preservation.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 8th December, 2025 4:32 PM