How to Trade Perpetual Futures on Giottus

Cryptocurrency trading has evolved beyond simple spot transactions where traders buy and hold coins. Today, one of the most popular and flexible instruments is perpetual futures. These contracts allow you to speculate on the price of cryptocurrencies without actually owning them. Unlike traditional futures, they have no expiry date, making them suitable for short-term strategies and long-term positions.

For Indian investors, Giottus makes perpetual futures trading accessible with user-friendly tools, strong security, and zero trading fees until September 2025.

Here’s a step-by-step guide to help you trade perpetual futures on Giottus confidently.

1. Getting Started with Giottus Futures

The first step is setting up and logging into your Giottus account.

Security should always come first in crypto trading. Giottus supports strong measures such as two-factor authentication (2FA) and OTP-based confirmations to protect your funds from unauthorised access.

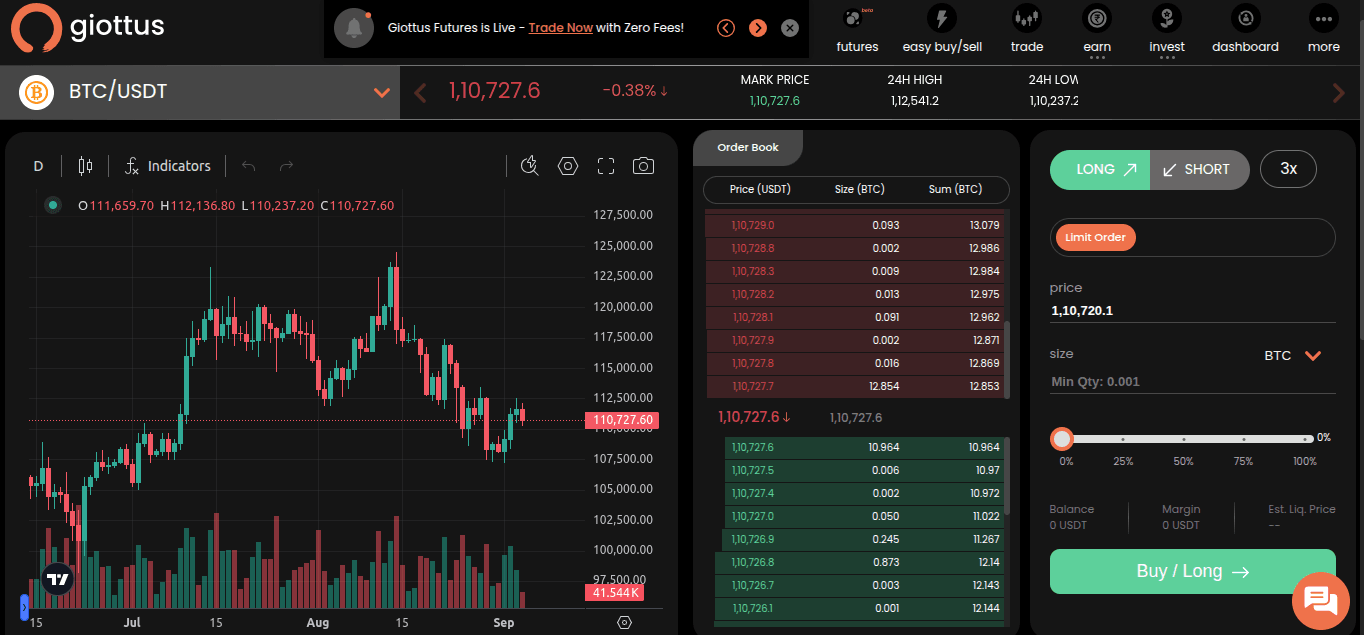

Once inside, navigate to the Futures Dashboard. This section is designed to be intuitive, even for beginners. It displays trading pairs, open positions, and important details like margin, PnL (profit and loss), and funding rates. If you’re new, start with small trades to understand the interface before committing larger amounts.

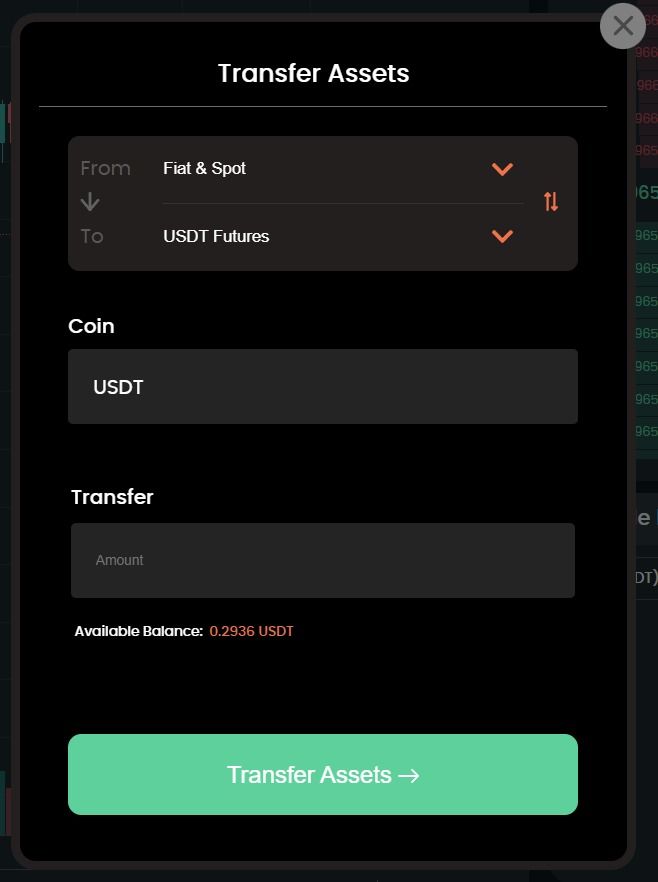

2. Funding Your Futures Wallet

Before placing a trade, you need to move funds into your Futures Wallet. Giottus makes this process seamless:

- Transfer crypto from your Spot Wallet to your Futures Wallet instantly.

- If you are buying crypto for the first time, Giottus offers Easy Buy Easy Sell (EBES), allowing INR deposits and instant conversion into USDT.

Funds reflect immediately, so you don’t lose trading opportunities while waiting for settlement. This speed is one of Giottus’ key advantages over slower exchanges.

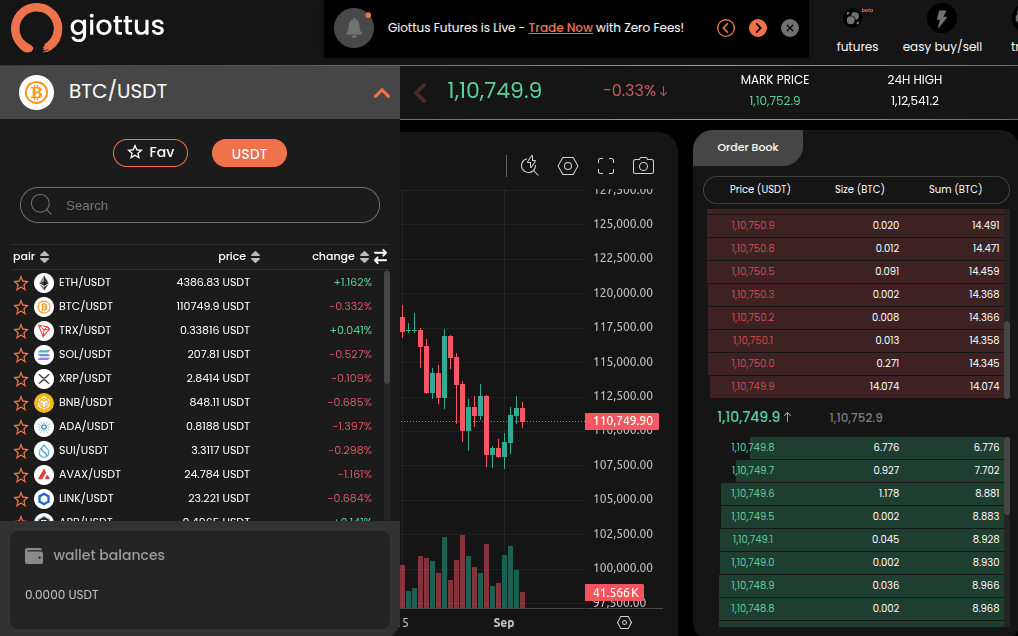

3. Choosing a Trading Pair

Your next step is selecting a trading pair. Popular perpetual futures pairs include:

- BTC/USDT – the most liquid and beginner-friendly.

- ETH/USDT – suitable for traders who follow Ethereum’s price moves.

- Other altcoins – for those seeking higher volatility and opportunities.

Liquidity is important because it ensures that orders are executed at fair prices without slippage. Beginners are generally advised to start with BTC/USDT, as it combines high liquidity with relatively predictable price patterns compared to smaller altcoins.

4. Opening a Long Position

A Long Position means you expect the price of a cryptocurrency to rise.

For example, if you believe Bitcoin will move from $60,000 to $62,000, you would go Long.

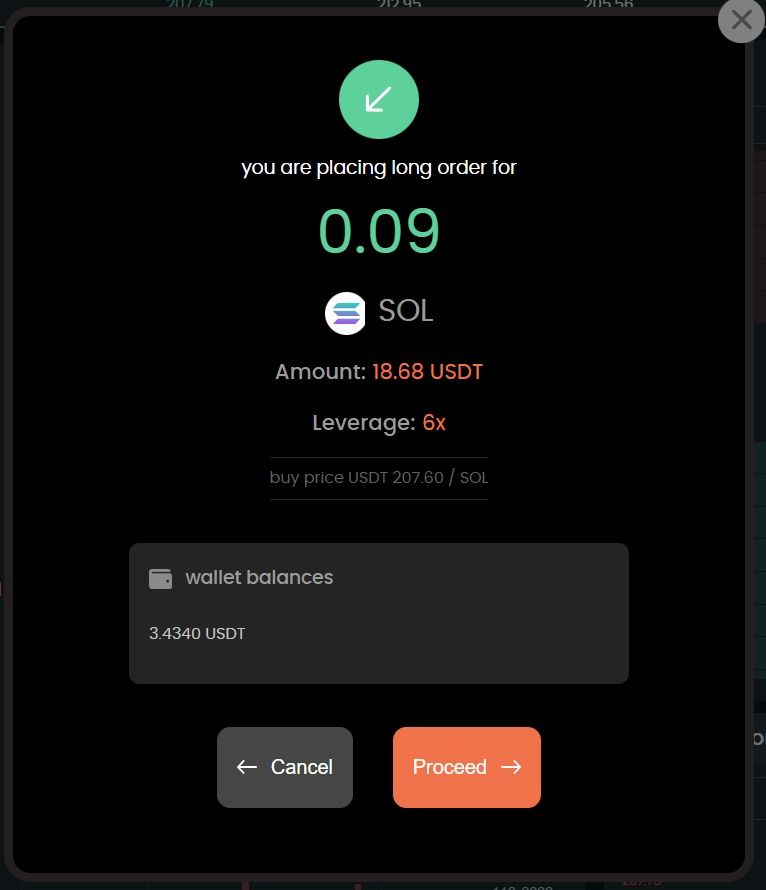

On Giottus, placing a Long is straightforward:

- Choose your trading pair (e.g., BTC/USDT).

- Enter the amount of USDT you want to use.

- Select order type – Market (instant execution) or Limit (specific price).

- Adjust your leverage, but beginners are better off keeping it low (2x–5x) to reduce risk.

- Confirm your position after reviewing details like margin used, liquidation price, and available balance.

5. Opening a Short Position

A Short Position is the opposite, you profit if the price falls. For instance, if you think Ethereum will drop from $3,000 to $2,800, shorting lets you benefit from that decline.

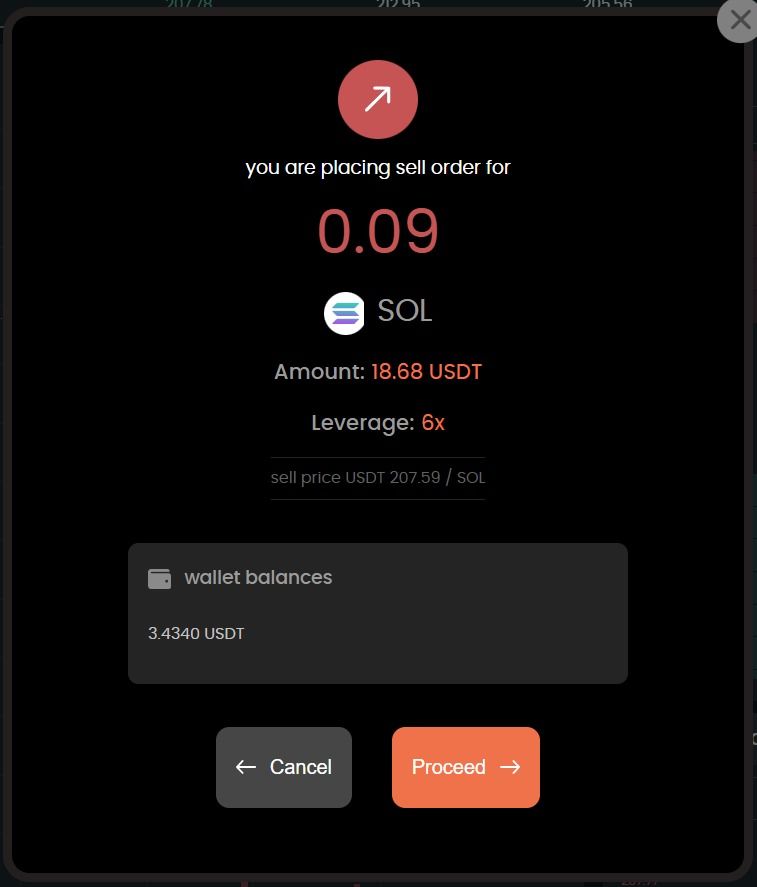

To Short on Giottus:

- Select the coin and trading pair.

- Enter your amount.

- Choose your leverage.

- Place the Short order.

One important point: you cannot hold a Long and Short on the same coin simultaneously. This ensures clarity in your strategy and prevents accidental overexposure.

6. Managing Active Positions

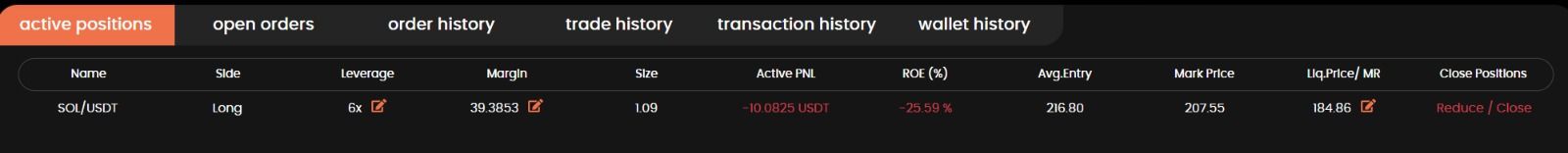

Once your trade is live, it appears in the Active Positions Tab. Here you can:

- Track unrealised profit or loss in real time.

- View your margin ratio, which indicates how close you are to liquidation.

- Monitor funding rates, which are periodic payments exchanged between Long and Short traders to balance the market.

Giottus’ dashboard keeps all these details visible in a simple format, allowing you to react quickly to price movements.

7. Closing or Reducing Positions

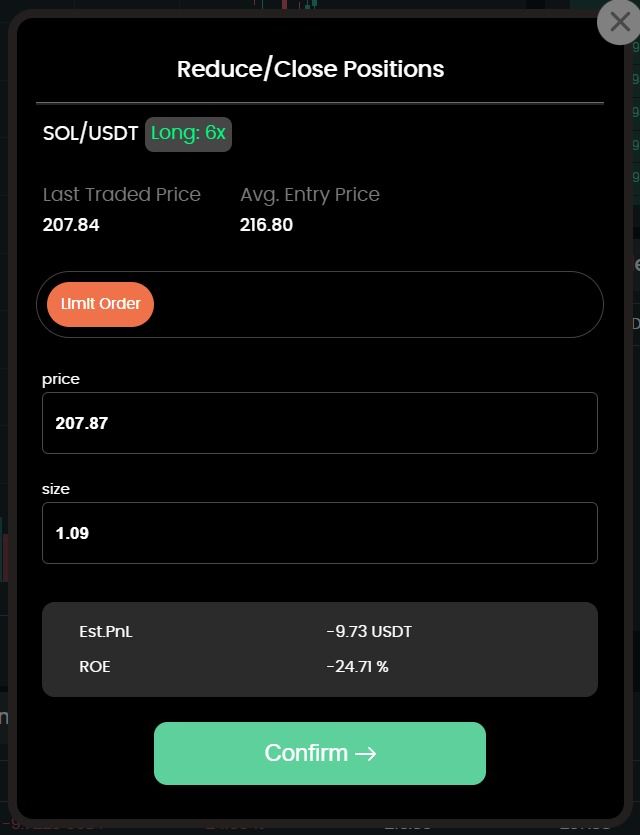

Knowing how to exit is as important as entering a trade. Giottus allows you to:

- Close positions fully when you are satisfied with your gains or want to cut losses.

- Reduce positions partially, locking in some profit while keeping part of the trade open.

This flexibility is essential for managing risk. For example, you might close half your position after a 10% profit and let the rest ride, securing gains without abandoning opportunity.

8. Fees, Benefits, and the Giottus Edge

Trading fees are often a hidden cost that eats into profits. But on Giottus Futures, trading is free until September 30, 2025. This is a significant advantage, especially for active traders who open multiple positions daily.

Other benefits include:

- Fast order execution with minimal slippage.

- Strong compliance with Indian regulations.

- INR-friendly options for deposits and withdrawals.

- A platform tailored for both beginners and advanced traders.

9. Best Practices for Beginners

Even though Giottus simplifies perpetual futures trading, it’s important to trade responsibly. Here are some best practices:

Start Small: Begin with low amounts until you are comfortable.

Keep a Buffer Margin: Always maintain extra funds in your wallet to prevent forced liquidation.

Avoid High Leverage: Leverage magnifies both profits and losses; beginners should keep it conservative.

Use Stop-Loss Orders: These help cap potential losses if the market moves unexpectedly.

Don’t Chase the Market: Patience and planning are more effective than impulsive decisions.

Also read: Crypto Perpetual Futures Trading FAQs

Conclusion: Why Trade Perpetual Futures on Giottus?

Perpetual futures trading offers exciting opportunities, but it comes with risks that demand discipline and understanding. For Indian traders, Giottus provides the perfect gateway , a secure, easy-to-use platform with zero fees (till Sept 2025), quick INR deposits, and strong safety features.

If you are exploring futures for the first time, Giottus allows you to learn and grow in a structured environment. By starting small, applying sound risk management, and steadily improving your skills, you can harness the potential of perpetual futures while protecting your capital.

Ultimately, success in crypto trading depends not just on predicting price movements but on building consistent strategies. Giottus equips you with the right tools to navigate the fast-paced world of crypto trading with confidence.

Updated on: 30th October, 2025 3:37 PM

FAQ's

1. What is leverage, and how is it used in perpetual futures?

Leverage allows traders to control a larger position with less capital. For instance, with 5x leverage, $1,000 can control a $5,000 position. While leverage can amplify profits, it also increases the risk of significant losses or liquidation if the market moves against your position.

2. Is there a fee while trading futures in Giottus?

There is no fee for trading perpetual futures on Giottus till November 15, 2025.