Solana’s ETF Approval Ignites a New Altcoin Wave

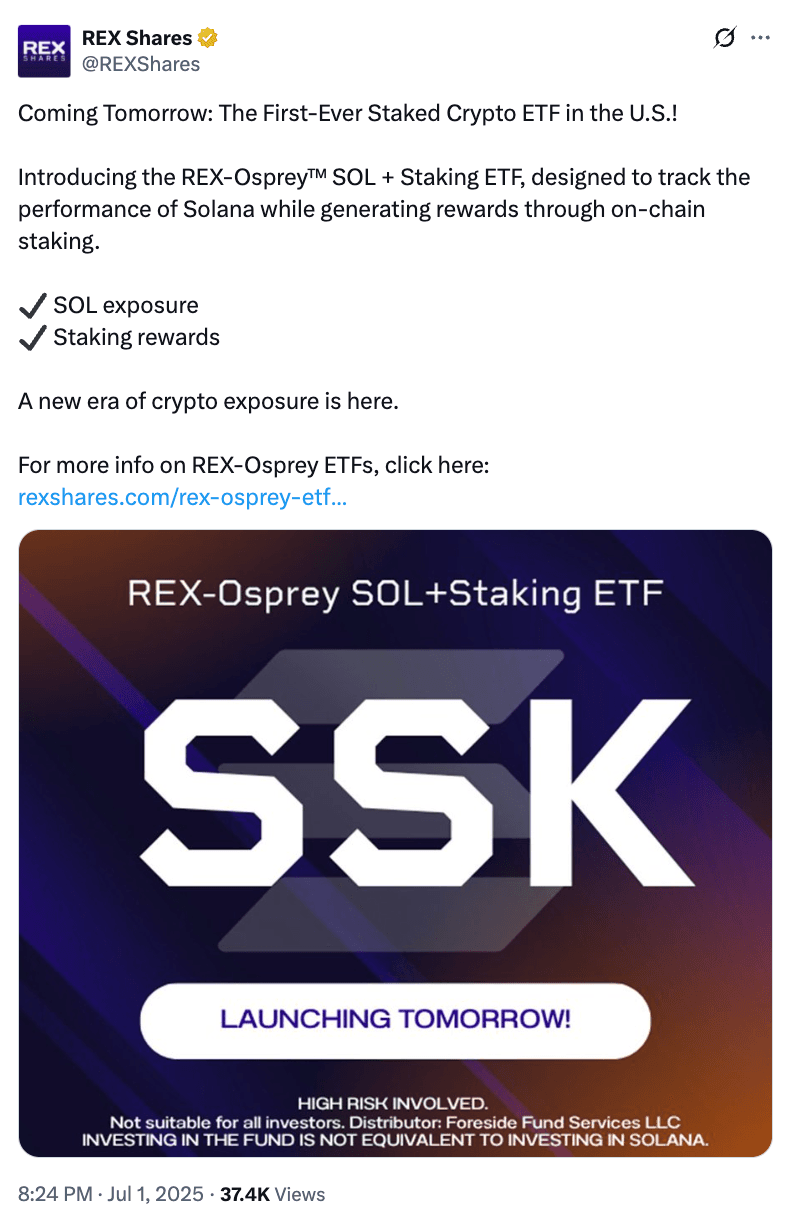

Solana (SOL) captured the headlines this week as the US SEC quietly greenlighted the first Solana Staking ETF (REX‑Osprey SSK), on Wednesday, July 2, 2025). Unlike prior spot‑only products, SSK combines direct SOL price exposure with built‑in staking yields near 7.3% annualized.

Within hours of launch, SOL vaulted 6–12% to $160, signalling that investors are keen to back high‑performance layer‑1 tokens alongside passive income from staking.

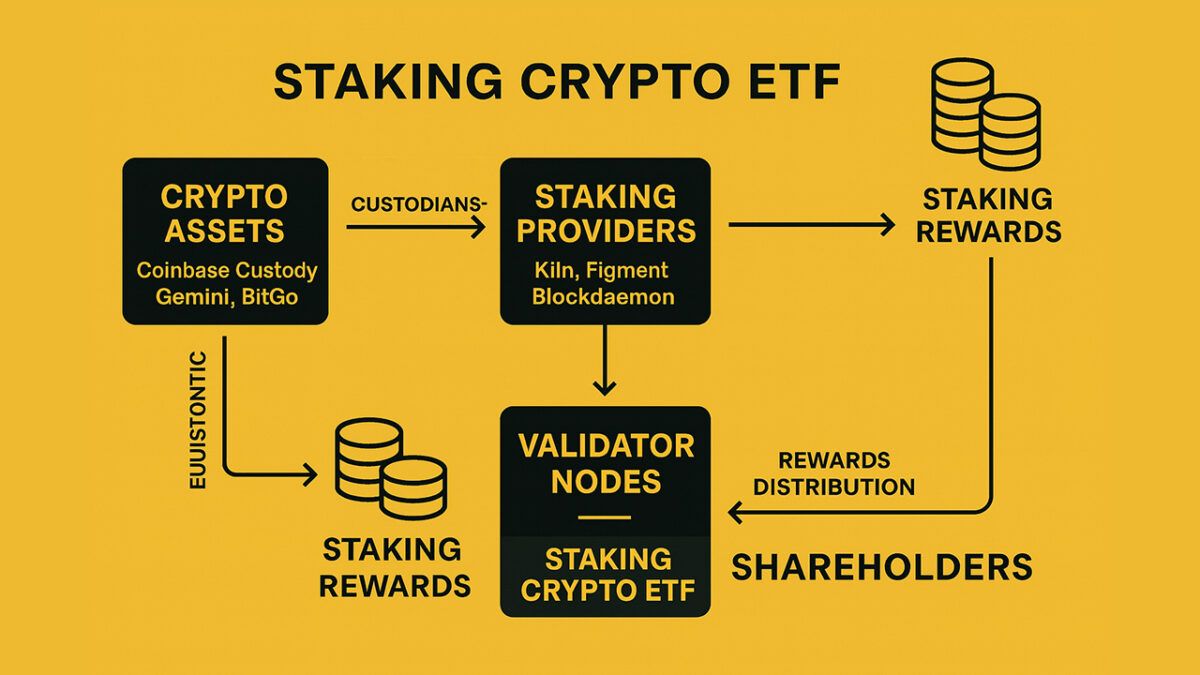

But first, what are staking ETFs?

Staking ETFs blend the familiar structure of a traditional ETF with the on-chain benefits of proof-of-stake networks like Ethereum and Solana. Instead of only tracking price moves, these funds earn and share out the network’s staking rewards either by growing the fund’s NAV or issuing periodic dividends. This turns crypto ETFs into yield-bearing assets, putting them on par with dividend stocks or bond funds and making them especially attractive to income-focused investors.

How do staking ETFs work?

Staking ETFs rely on a regulated custodian - think Coinbase Custody or Gemini to hold the crypto and delegate it to professional node operators like Kiln or Figment. Those validators secure the network and collect rewards, which the ETF provider then passes on after deducting operating fees. Depending on the fund’s setup, rewards either boost the share price directly or get paid out as dividends. In either case, investors gain passive exposure to both price upside and on-chain staking yield without running a wallet or managing validator keys.

Source: Cryptotimes

Solana ETF approval and why it matters

The REX‑Osprey Solana + Staking ETF is structured to hold 80% direct SOL over half staked via institutional validators like Galaxy and Figment, plus a slice in liquid staking tokens such as JitoSOL. By using the CME CF Solana-Dollar Reference Rate for spot pricing and passing 100% of staking yield to investors, SSK sidesteps futures-roll costs and wallet management headaches.

Source: REX Shares on X

The SEC’s nod to SSK marks a pivotal shift in regulatory thinking - staking rewards are now considered asset returns, not securities. That clarity paves the way for future spot and staking ETFs on Solana and beyond.

Institutional issuers like VanEck and 21Shares are already lining up applications, betting on a broader altcoin ETF boom by year‑end. For retail traders, the result is a simpler on‑ramp: SOL enters brokerage accounts with no wallet toggling or third‑party custodians.

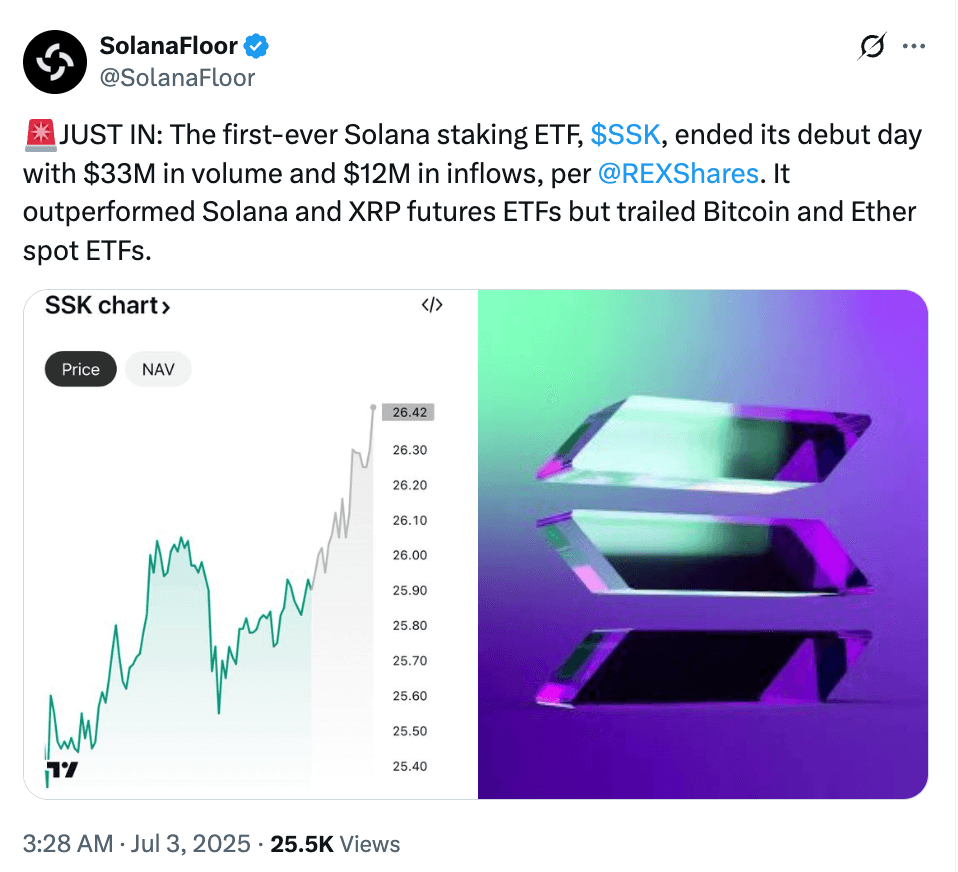

SOL price reaction and debut ETF performance

In the first trading days, SOL rocketed on heavy volume, outpacing Bitcoin’s 3% and Ether’s 4% ETF-inflow driven gains. SSK itself registered $33 million in first-day volume, raking in $12 million in inflows, ranking it among the top 1% of all ETF launches, while SOL’s staking yield supports a tight premium to NAV.

Source: SolanaFloor on X

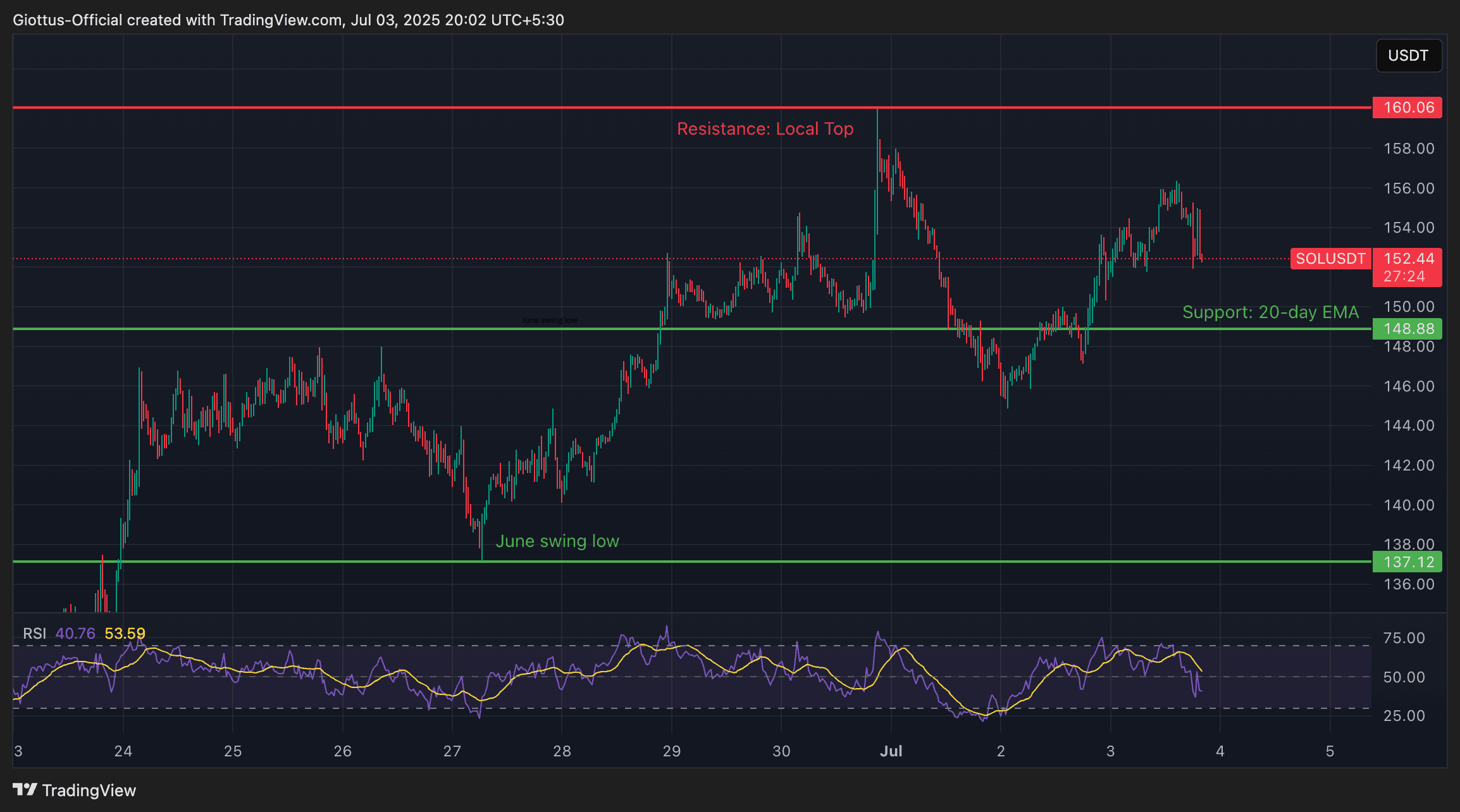

Can the rally sustain though?

SOL leapt nearly 8% to a high of $160 on news of the SSK debut, riding a wave of speculative buying as traders eyed new ETF-driven demand. Volume spiked to $4.5 billion, 120% above its weekly average, highlighting heavy participation. Yet SOL failed to hold its gains, pulling back to around $157 within 24 hours as profit-taking set in.

Source: Giottus in Trading View

From a technical standpoint, SOL’s RSI hit overbought levels above 70 and has since cooled back (48) toward neutral territory. The immediate resistance zone lies between $160–$165 (local top), while support sits at $148 (the 20‐day EMA) and $137 (the June swing low). Traders should watch for a clear break above $162 on strong volume to confirm sustained momentum.

ETF pipeline and altcoin season ahead?

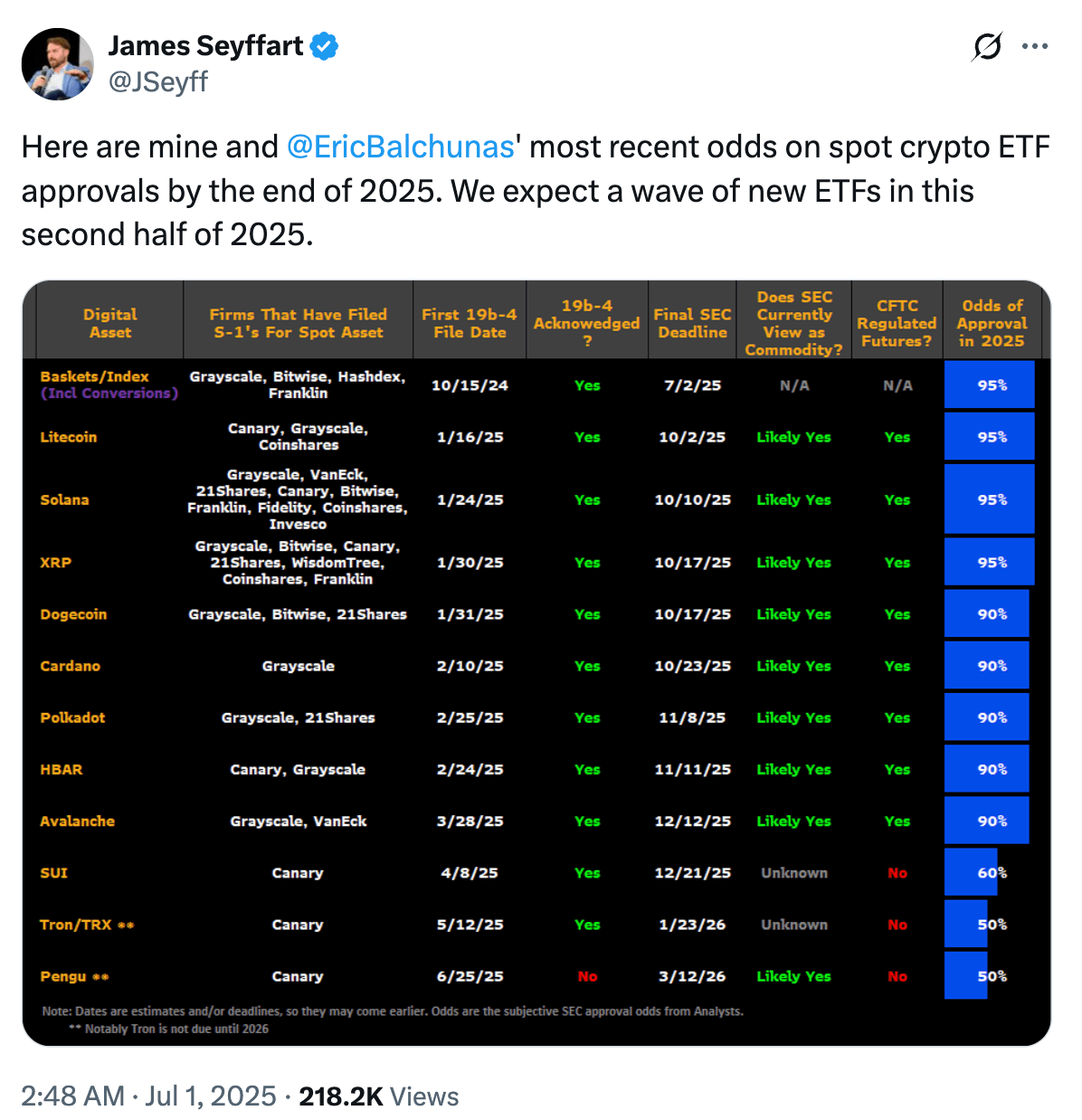

SSK’s success has spurred at least nine more Solana ETF filings under SEC review, including pure spot SOL products. Analysts see high odds for additional approvals by Q4, 2025. Meanwhile, applications for Cardano, Litecoin, and XRP ETFs are in the queue. A broader altcoin ETF suite will offer retail traders new tools to diversify, marking a shift from the Bitcoin-Ethereum duopoly to a multi-token era.

Source: James Seyffart on X

Key takeaway

Solana’s staking ETF debut proves that combining spot exposure with on-chain yield can ignite fresh demand, even as broader market conditions stay mixed. The SSK launch pushed SOL above key technical levels on heavy volume, yet profit-taking and looming staking unlocks remind traders that headline catalysts need healthy follow-through. Watching SOL’s ability to hold above the $160–$165 zone on sustained volume will be crucial to gauge whether this rally has legs or is simply a fleeting ETF-driven spike.

Looking ahead, a crowded pipeline of pure-spot and staking ETFs for Solana and other altcoins could redefine portfolio allocations—and lower barriers for retail investors. As applications for Cardano, XRP, and Litecoin funds roll in, traders will have more ways to target network yields and price appreciation under a regulated umbrella. The next few months will show whether this wave of altcoin ETFs delivers durable inflows or simply spreads thin the initial excitement that Solana has captured.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 30th July, 2025 5:25 PM