Sonic is the new Fantom

Remember Fantom?

Fantom’s (3,3) model set off a powerful DeFi momentum, nearly reshaping the space and inspiring the later x(3,3) concept. In 2020, Andre Cronje, a pioneer in decentralized finance, introduced YFI, which exploded from $6 to $95,000. The following year, he threw his support behind FTM, distributing $800 million in airdrops and driving its value up 180x, with Fantom’s TVL peaking at $6.9 billion.

Developers and early users raved about Fantom’s testnet, praising its seamless experience. However, fierce competition from Solana and Avalanche soon overshadowed its progress. Things worsened when the Multichain bridge collapsed, causing Fantom’s TVL to plummet to $90 million.

As the bear market took hold, Cronje’s unexpected retirement in 2022 left the community in shock, marking what many feared was the end of Fantom’s golden era.

Well, he returned in 2023 and made bold statements such as this - “Blockchain Tech 'Stuck in the Eighties”. His vision included a key upgrade to Fantom's tech stack called Sonic - optimized, as the name suggests, for speed. Following this, the network launched testnet and mainnet in consecutive years promising breakneck transaction speed.

Suddenly, everyone's excited again, and money is pouring back in. Sonic (ticker S) is promising impressive stats which is way faster than most other blockchains.

Sonic is backed by an unmatched tech foundation

Sonic’s architecture is built for speed, scale, and security. Its impressive specs include:

• 10,000 transactions/sec: Making it one of the fastest L1 chains

• Finality in <1 second: No waiting for confirmations

• <$0.01 fees per txs: Ultra-low fees

Source: X

At the core of Sonic’s success is its a BFT consensus mechanism, which eliminates the need for traditional Proof-of-Work (PoW) structures or prolonged confirmation times. This makes Sonic ideal for real-time DeFi applications, significantly improving user experience.

Adding to its interoperability, Sonic Gateway serves as a secure bridge to Ethereum, allowing seamless asset transfers. Key assets like USDC, EURC, WETH, and FTM (now S) can move effortlessly between networks, thanks to a partnership with Circle that introduced bridged USDC (USDC.e) to Sonic.

The S token plays a central role in the ecosystem, powering:

• Transaction fees

• Staking and validator rewards

• Governance and network security

• DeFi Ecosystem

Since launch, Sonic has quietly but steadily built a thriving DeFi ecosystem. While initial hype may have tempered, the fundamentals show strong and sustained growth.

To drive adoption, Sonic Labs has launched a massive $190 million S token airdrop, rewarding liquidity providers and users engaging with the network. The airdrop is complemented by the Sonic Points Program, designed to gamify participation and maximize rewards.

Monitization model

One of Sonic’s standout features is its developer incentive model, where Devs earn up to 90% of the fees generated by their applications. This revenue model mirrors YouTube’s ad-sharing approach, creating a developer-first environment.

Source: Sonic Labs Blog

Sonic's transaction fees are split based on whether an app participates in their "Fee Monetization" (FeeM) program. FeeM is designed to directly reward developers for building popular, active applications on the Sonic blockchain. Apps that join FeeM share a large portion of their transaction fees with the developers, encouraging them to create engaging platforms. Transactions from apps outside the FeeM program are treated differently, with a portion of the fee being burned, which reduces the overall supply of Sonic's S token, and the rest going to validators and the ecosystem vault.

Here's a quick fee summary

FeeM Apps:

- Developers get up to 90% of the transaction fees

- Remaining fee goes to validators

Other Apps:

- 50% of the fee is burned.

- Remaining fee goes to validators and ecosystem vault.

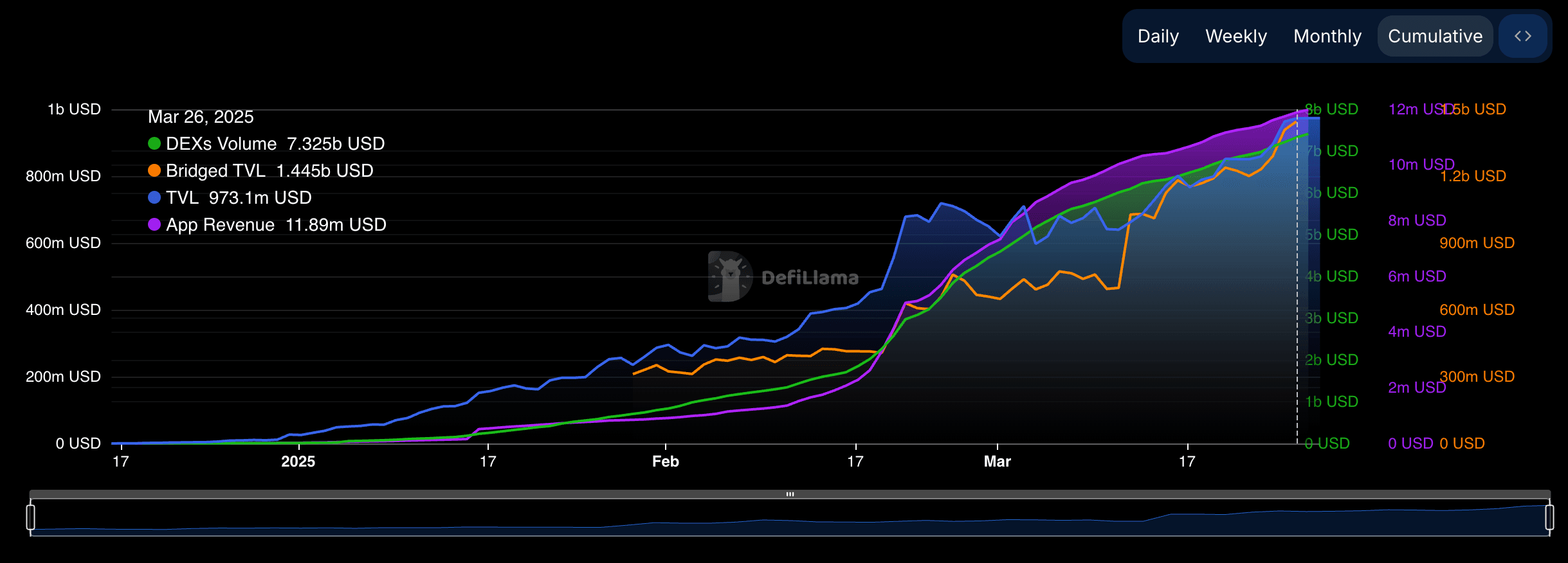

Sonic’s Explosive Growth

Sonic’s numbers tell a story of rapid adoption and deep liquidity. Sonic is the only L1 with over $1B TVL that has seen a positive change in TVL in the past week, proving its staying power.

• Total Value Locked (TVL): $973 million (up 3,700% since January)

• Bridged TVL: $1.4 billion

• DEX trading volume: $7.4 billion

• App revenue: $11.9 million

Source Defillama

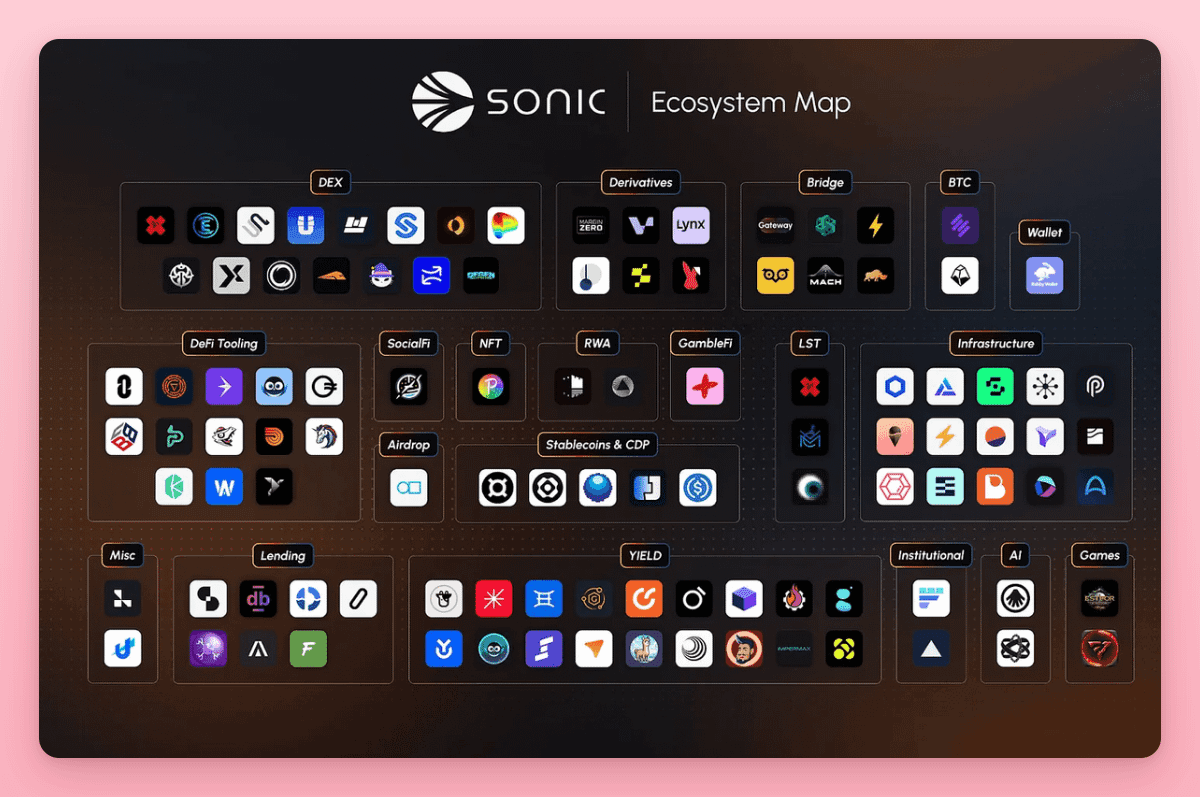

Key Players in the Sonic Ecosystem

1. SwapX – Sonic’s native DEX, leveraging Algebra V4 for concentrated liquidity and tokenomics. Strong LP incentives and referral rewards.

2. Shadow Exchange – Largest DEX on Sonic with $2.7 billion in cumulative trading volume and $79 million in TVL

3. Beets – Sonic’s flagship liquid staking hub. Largest LST provider on Sonic with $247 million in TVL.

4. Silo Finance – Largest lending platform in Sonic with $281 million in TVL

Source: X

Final Thoughts: Why Sonic Matters for Web3

Sonic marks Fantom's resurgence, driven by a focus on high-speed transactions and a developer-centric ecosystem. Its architecture, designed for rapid finality and low fees, aims to address core scalability challenges in blockchain. A unique fee-sharing model incentivizes developers, fostering a vibrant application environment.

Sonic's strategic direction and architectural enhancements position it to become a significant player in the evolving landscape of Layer-1 blockchains. By prioritizing developer engagement and transaction efficiency, Sonic is poised to redefine decentralized finance applications and establish a sustainable ecosystem for future growth.

The Sonic Boom is just getting started. Start your journey today - buy now in Giottus.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 19th November, 2025 1:27 PM