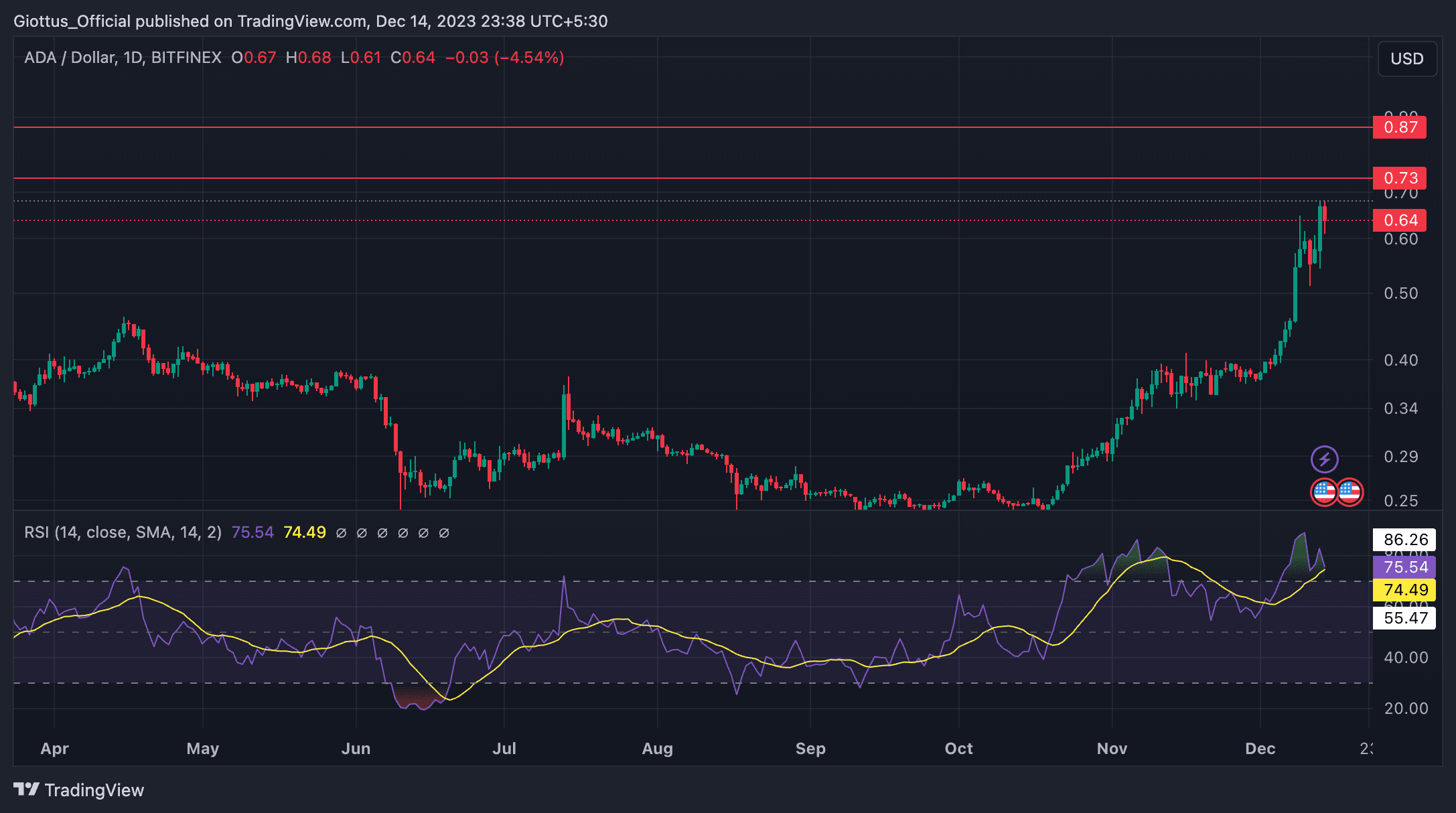

Well, it looks like Cardano has finally got into rally mode. From a low of $0.24 in October, ADA is now trading near $0.64, a growth of 166%. A nice 40% of this happened this week.

This week, ADA recovered from early selling pressure. If market conditions continue to remain positive, the post-breakout rally is expected to continue to key levels, particularly $0.737 and $0.87, providing a potential growth of 35%. ADA’s RSI has also breached the overbought territory and is currently cruising above 75.

ADA/USD chart. Source: TradingView

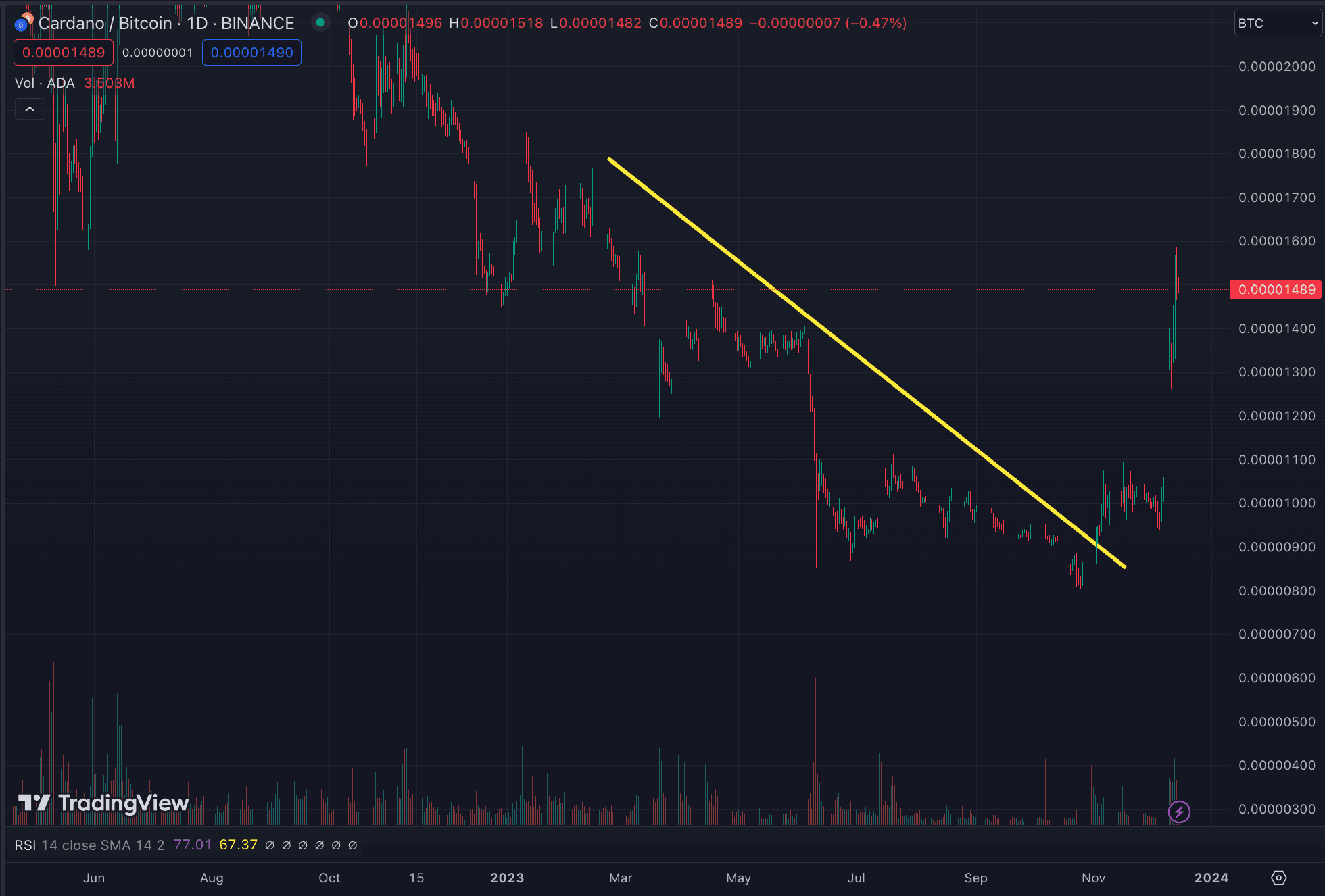

What’s more impressive is that ADA has broken out of a descending trendline against BTC.

ADA/BTC chart. Source: TradingView

Price action is one thing. We must also consider how other metrics are tracking. Let's dive in.

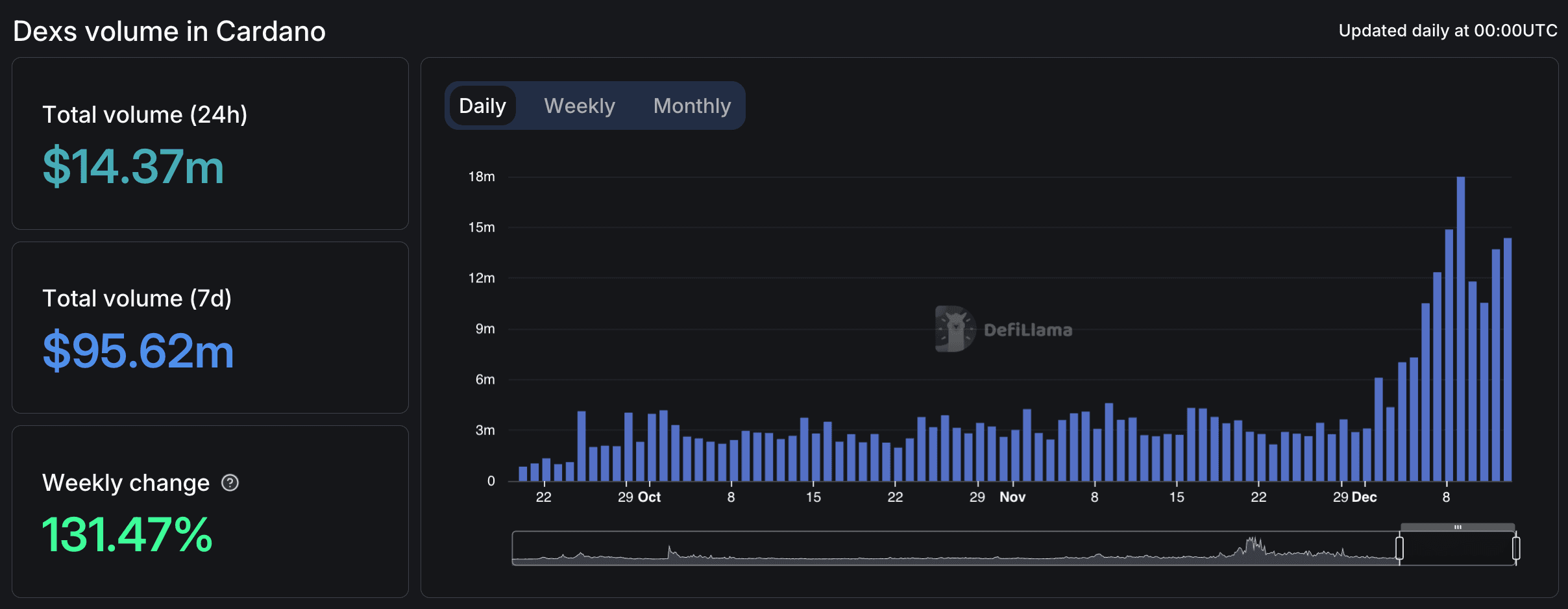

1.DeFi ecosystem showing signs of recovery

While Cardano has stellar partnerships and development teams, they were constantly criticised for lesser activity on the chain. This new altcoin rally has led to a shift in the DeFi activity for the protocol. This represents a significant turnaround for a network whose DEXs processed less than $50 million in transactions in September. If the current trend persists, the chain will breach the $100 million weekly trading volume mark for the first time since May.

Source: DefiLlama

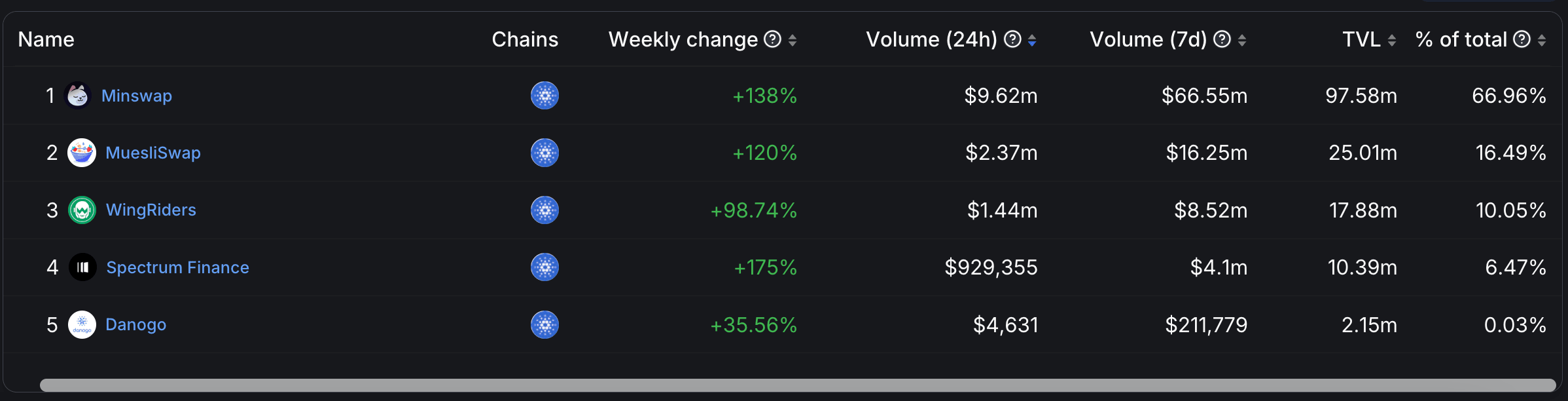

2.Users speculate across the ecosystem

Value added to the Cardano ecosystem has been climbing steadily since the start of the altcoin rally. Crossing $500 million last week, the total value locked (TVL) of all Cardano-based tokens has jumped to $527 million. Meanwhile, TVL on both small and large protocols (Minswap and Spectrum Finance) has surged multifold, suggesting that users are starting to take riskier bets.

Source: DeFiLlama

3.Whale activity fuels growth

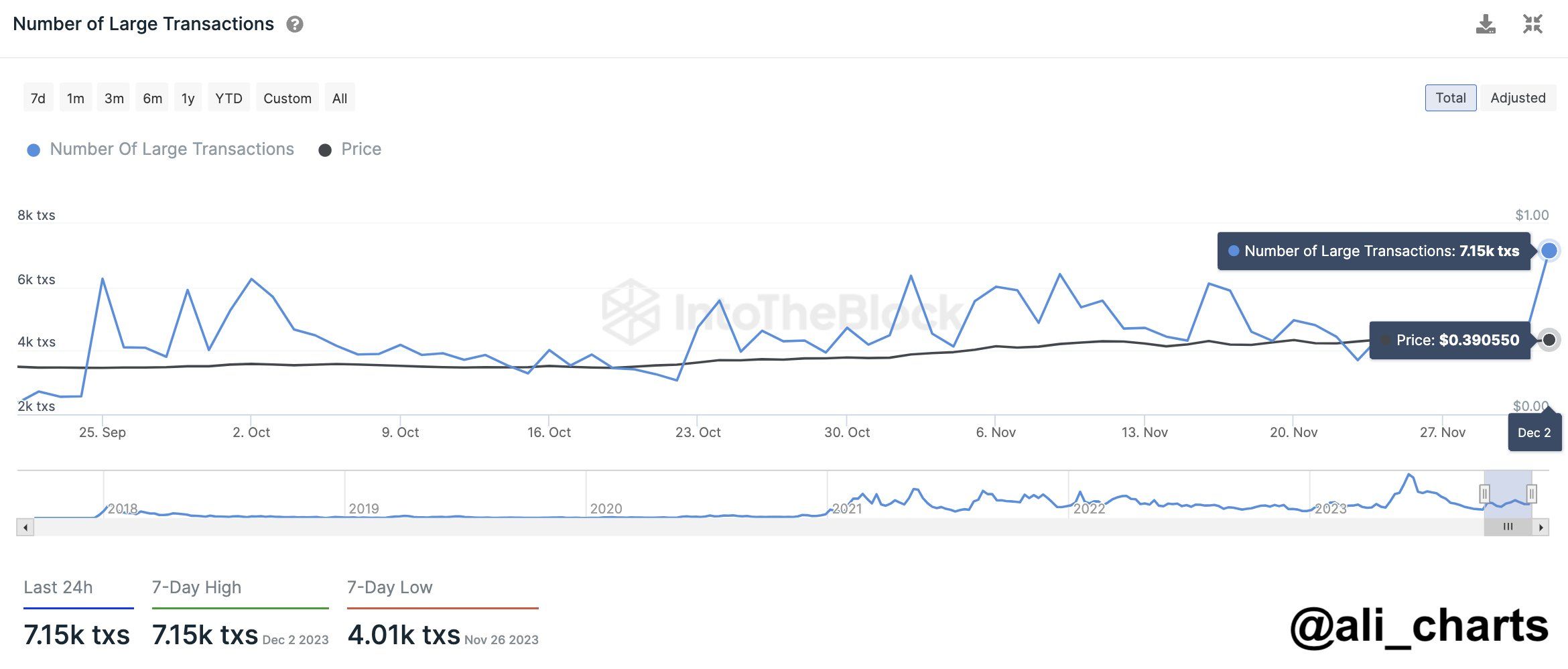

Ali, a crypto analyst, has stated that Cardano has seen a surge in whale activity in recent months. Citing on-chain data, Ali noted that in the past three months, there has been a significant increase in large transactions, that is, ADA transactions over $100,000. This value has regularly reached new highs.

According to on-chain analytics platform IntoTheBlock, large transactions on the Cardano network topped $1.5 billion over the prior 24 hours. These high-value transfers suggest renewed investor interest, especially amongst large bag holders (whales) who conduct transactions over $100,000 in size. This influx of big money has propelled Cardano’s overall volume to $19.5 billion while its market capitalization sits near $23 billion.

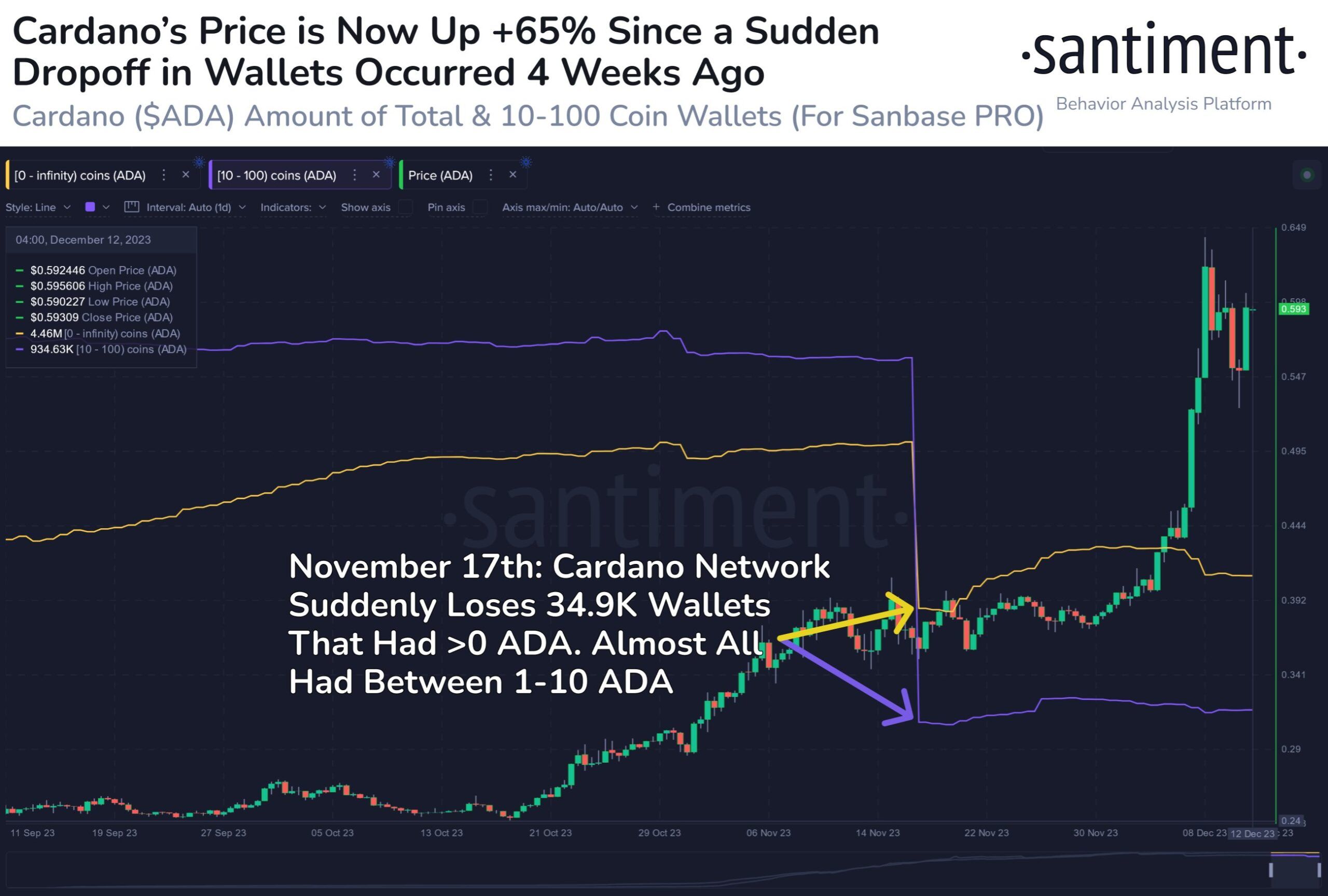

4.Exodus of small wallets signals accumulation

Data from Santiment reveals that the mysterious loss of 34,900 addresses holding 1 to 10 ADA coincided with a significant turning point in the price trajectory on November 17. We can infer that a drop of such magnitude signals an accumulation phase.

What’s ahead and what can investors do?

- Cardano was a leading blockchain in the last bull run. ADA put in an impressive 100x from 2019 to 2021. While it was a darling of the masses then, its support has been muted in since 2022.

- Of late, the layer 1 market (excl. Ethereum) feels crowded with Solana standing out with its institutional support and thriving ecosystem. However, Cardano seems to be building a more robust tech that can be resilient over the years.

- ADA has potential to top its all-time high of $2.9 this bull run which would be a 5x from current levels.

- The current rally can take a U-turn post January – investors may be able to buy ADA back at $0.4 levels which will be a solid zone to accumulate for the next 2 years.

Not subscribed to Cryptogram yet? Subscribe here

Disclaimer: Crypto-asset or VDA investments are subject to market risks such as volatility and have no guaranteed returns. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.