Bitcoin leaps into an uncharted territory

Bitcoin’s surge to new all-time highs is propelled by multiple forces coming together. Institutional demand from corporations. ETF inflows, improving regulatory clarity and a more stable geopolitical backdrop, have all contributed to renewed investor confidence and upward momentum in the market. We deep dive into some of these today.

ETF inflows power Bitcoin’s climb

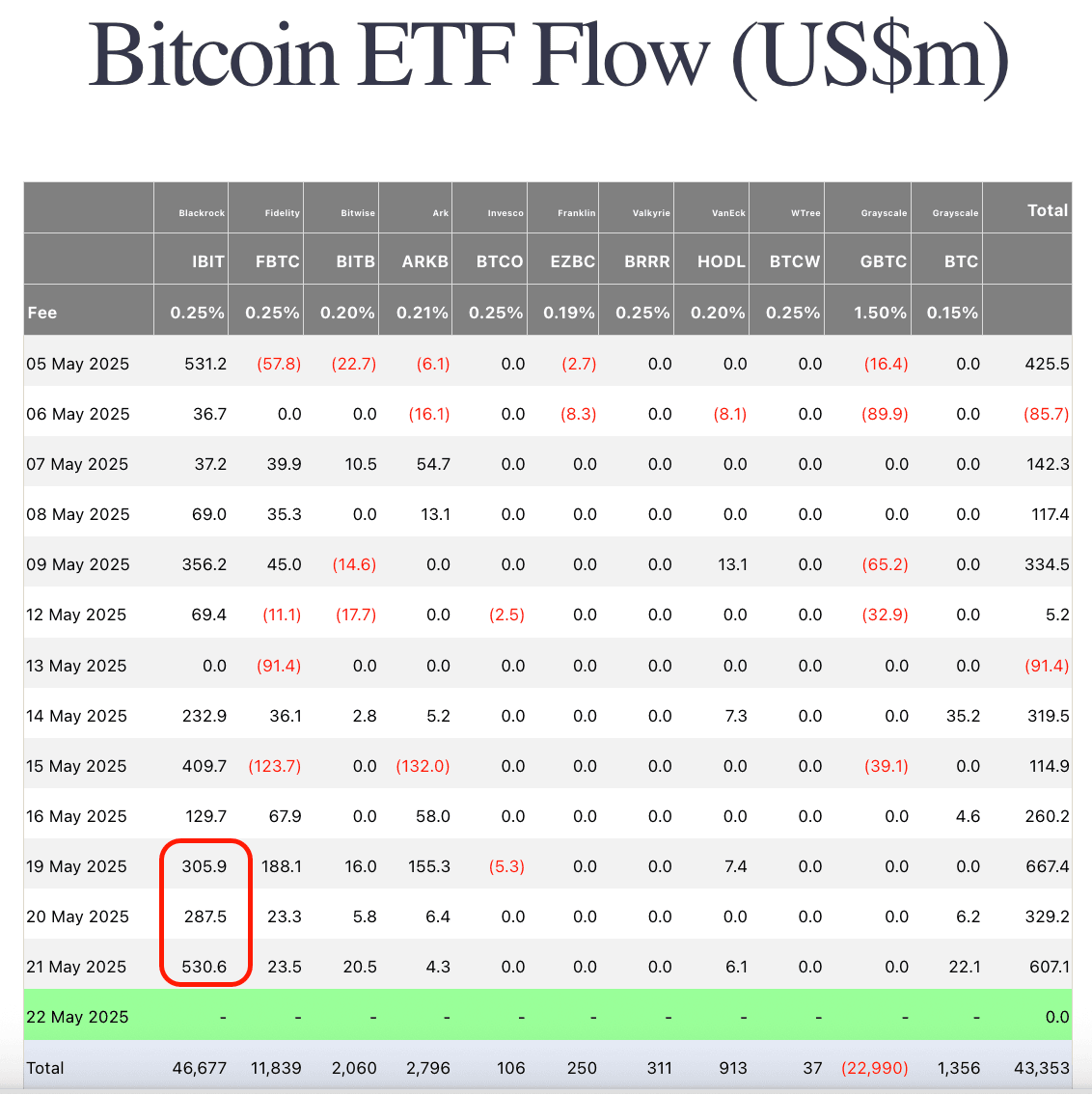

Bitcoin’s latest rally, pushing it near $112,000, has been fuelled in large part by massive inflows into US spot Bitcoin ETFs - especially BlackRock’s iShares Bitcoin Trust (IBIT). On May 21, IBIT recorded a staggering $531 million in net inflows, its highest single-day total in over two weeks. The ETF added 4,931 BTC in just one day - over ten times the amount mined globally in a day. IBIT hasn’t seen a single outflow since April 9, underscoring persistent institutional demand.

Bitcoin US Spot ETF inflows. Source: Farside

Corporate demand is outpacing Bitcoin’s supply

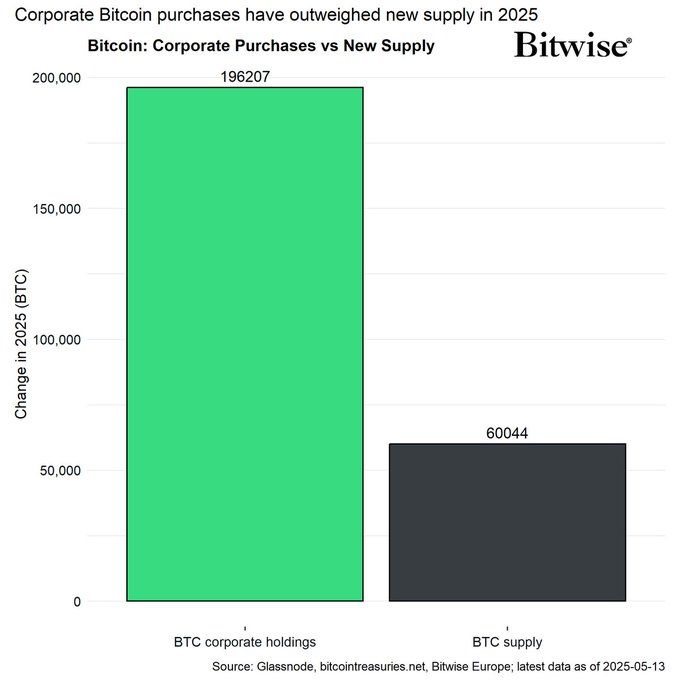

In 2025, corporate interest in Bitcoin has reached peak levels, with public companies acquiring over 196,000 BTC - more than triple the roughly 60,000 BTC newly mined this year. This 3.3x demand-to-supply shows a major shift in how businesses see Bitcoin: not just as a risky bet, but as a serious long-term asset to hold on their balance sheets.

Bitcoin supply v/s corporate demand. Source: Bitwise in X

Over 70 public companies now hold Bitcoin, up from just a few in 2024, reflecting a broader institutional pivot toward viewing it as a long-term store of value. With corporate buyers and ETFs absorbing more Bitcoin than miners can supply, the available exchange liquidity is shrinking rapidly. This tightening supply dynamic, driven by aggressive accumulation, sets the stage for sustained upward price pressure and a potentially transformative phase in Bitcoin’s market structure.

Regulatory tailwinds strengthen market confidence

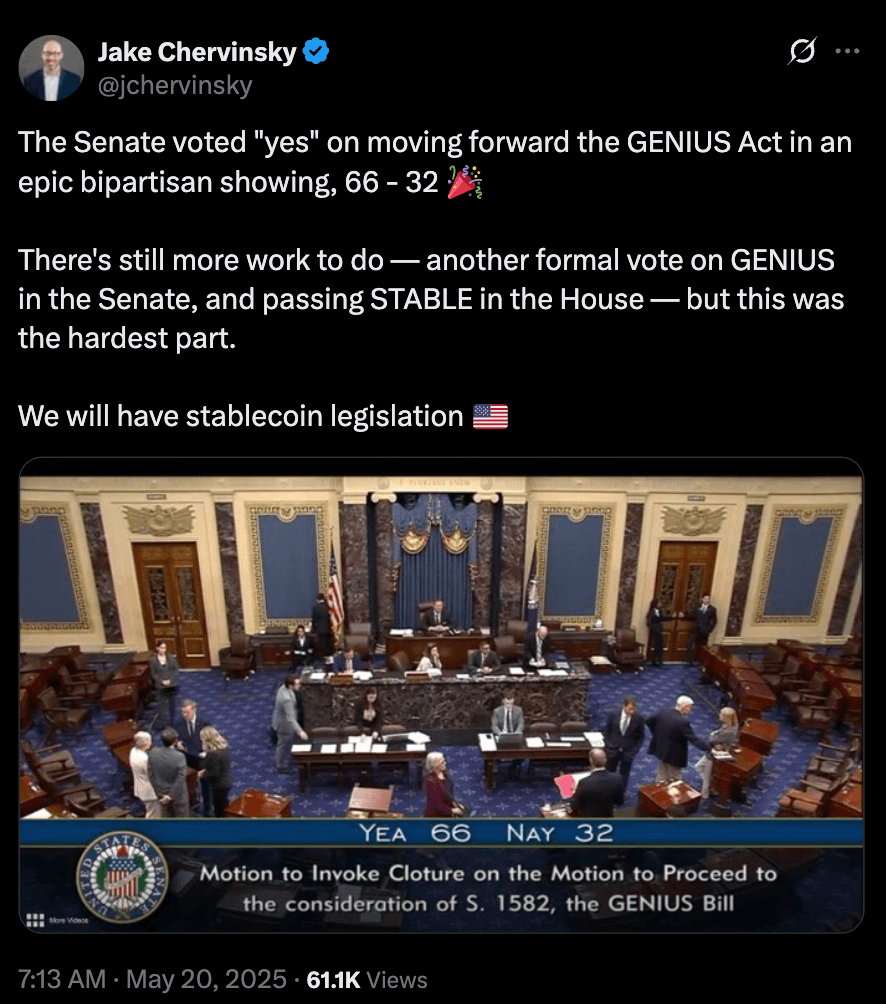

Among the most impactful developments has been the advancement of the GENIUS Act in the US Senate. This bill proposes a comprehensive regulatory framework for stablecoins - a foundational component of the crypto ecosystem. By aiming to bring legal clarity and oversight to stablecoin issuers, the GENIUS Act signals a maturing regulatory environment. This move has been broadly welcomed by market participants, who view it as a key step toward legitimizing digital assets and encouraging responsible growth in the sector.

Source: Jake Chervinsky on X

However, Binance netflows hint at potential selling pressure

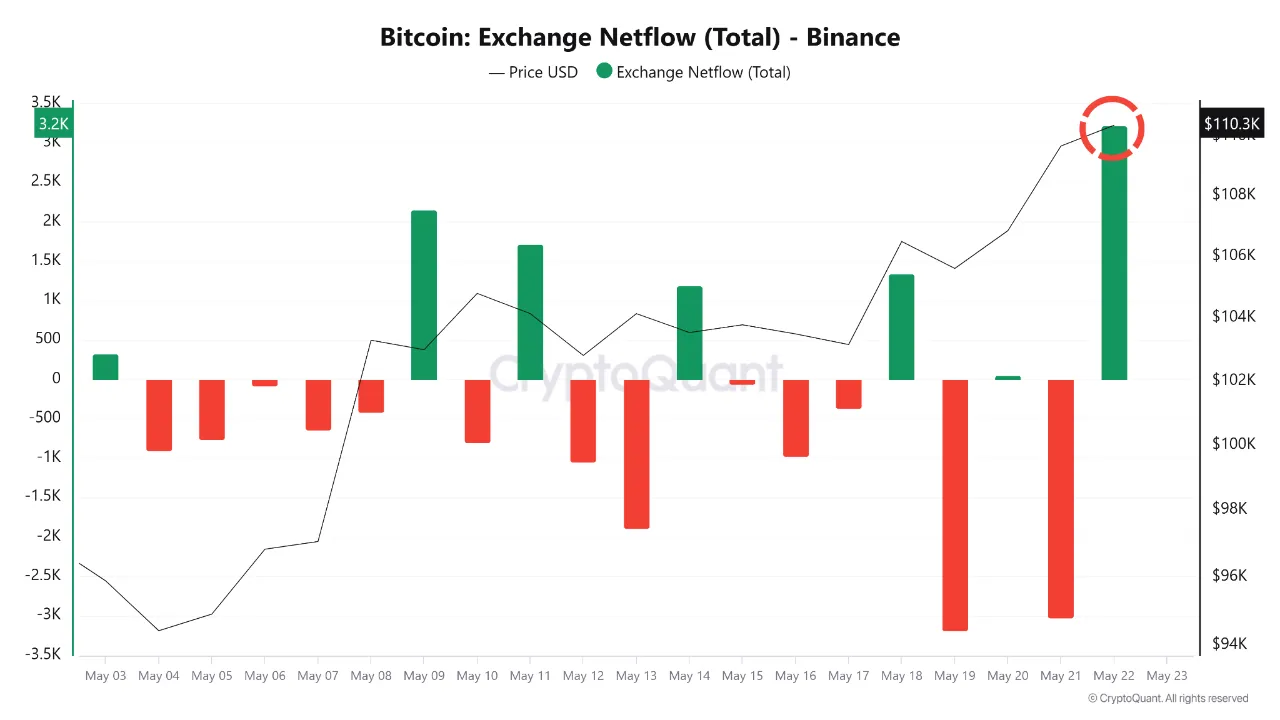

As Bitcoin soared to a new highs, a notable shift occurred on Binance - netflows turned sharply positive, with over 3,000 BTC flowing into the exchange. This is a key signal worth watching. Historically, large inflows to centralized exchanges suggest that investors are preparing to sell, either to lock in profits or to react to perceived market tops. While institutional demand through ETFs continues to drive broader bullish momentum, this sudden spike in exchange-held BTC may foreshadow short-term volatility or a cooling-off period. In essence, while the long-term outlook remains constructive, traders should be alert: heavy inflows at peak prices often precede localized corrections.

Binance BTC inflows. Source: Cryptoquant

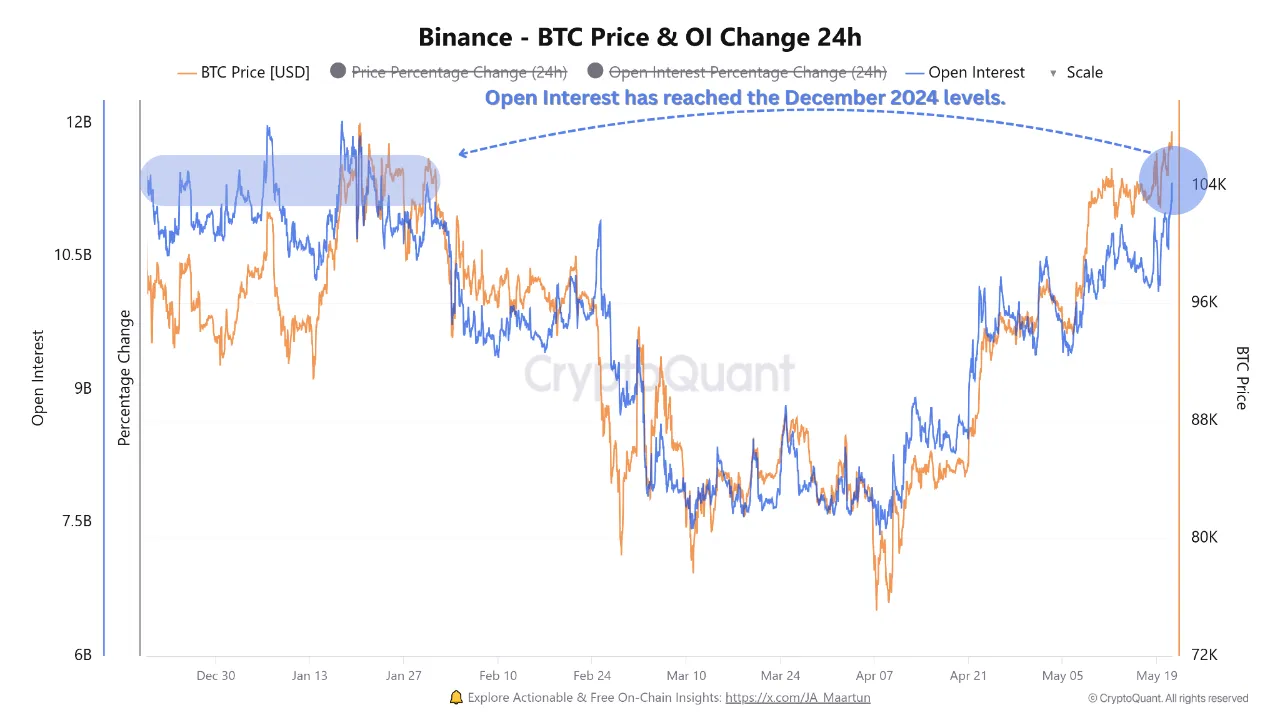

High open interest - fuel for momentum or risk of reversal?

Bitcoin open interest (OI) on Binance has surged past $12 billion, reaching levels last seen in December 2024. This jump reflects a sharp rise in speculative activity within the derivatives market. Elevated OI during an uptrend often supports bullish continuation, especially when it’s matched by strong spot market inflows. However, when this leverage isn’t backed by new demand or capital, it can quickly turn into a vulnerability.

Bitcoin open interest on Binance. Source: Cryptoquant

The chart shows OI climbing in lockstep with Bitcoin’s price, suggesting that traders are increasingly betting on further upside. But this also raises the risk of a cascade if positions become too leveraged and sentiment turns. With funding rates likely rising and exchange inflows ticking up, this high OI environment presents a double-edged setup - momentum can continue, but the margin for error is shrinking. Prudent traders will monitor whether this OI is supported by real buying pressure, or if it's merely built on fragile leverage.

Also read: Bitcoin or Gold? Maybe both!

Key takeaway: A defining moment; caution is warranted

Bitcoin’s breakout above $110,000 marks a defining moment for the asset, driven by a rare confluence of bullish catalysts: surging ETF inflows, record-breaking corporate demand, and landmark progress on US crypto regulation through the GENIUS Act. These developments collectively signal a structural shift in Bitcoin’s market narrative - from speculative asset to institutional cornerstone.

For retail investors, this rally presents an opportunity to consider partial profit-taking, especially after such a strong move fuelled by institutional inflows. Locking in gains at key milestones allows for disciplined portfolio management without exiting the trend entirely. Meanwhile, those using high leverage should proceed with caution. Exchange inflows and rising open interest suggest increased speculative activity - conditions that can turn quickly if sentiment shifts. While the long-term outlook for Bitcoin remains compelling, risk management is essential at these elevated levels.

For more details, check Giottus homepage.

Also read: Top 5 Cryptocurrencies to Buy in 2025.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 8th December, 2025 4:38 PM