Ethereum sets sights on $4,000

Ethereum (ETH) has pushed past $3,650 today, driven by notable inflows from institutions and a rise in trader confidence. ETH now sits just below its next barrier at $3,800 and the psychological $4,000 mark (<10% away).

This move comes alongside higher daily transaction counts, growing staking participation, and a widening gap in market dominance versus Bitcoin. Today, we’ll examine the on-chain and market signals pointing to why Ethereum’s rally could extend into the $4,000 zone.

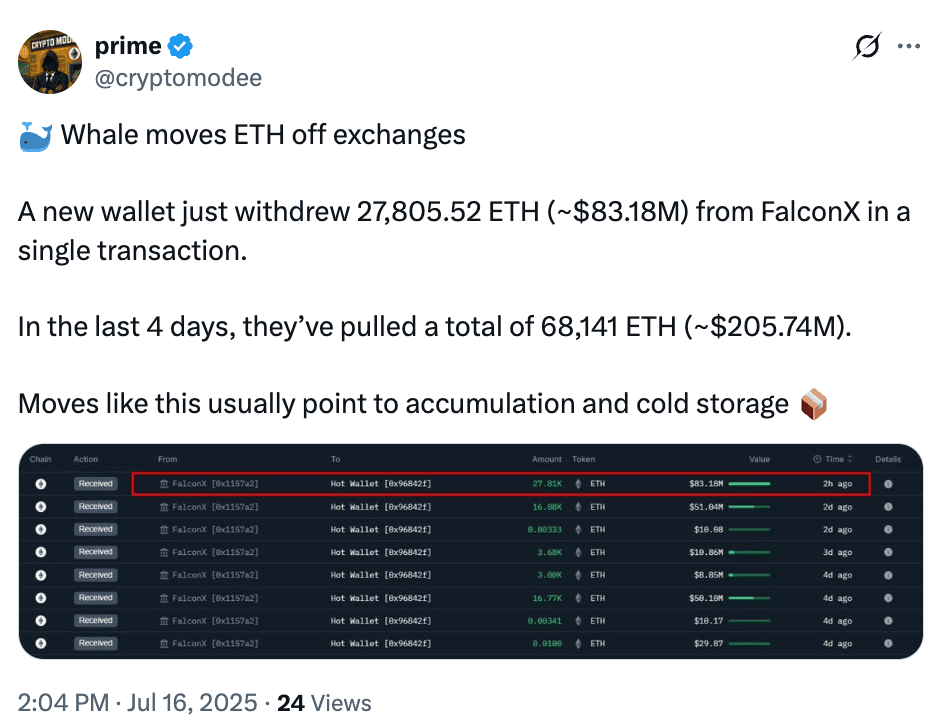

Whale activity and smart money moves

On-chain data shows a rise in whale accumulation - large investors are moving ETH into cold storage and staking contracts, often a bullish sign. These large transfers signal strong confidence in Ethereum’s future price performance. Historically, such activity often precedes larger breakouts as retail investors follow the lead of “smart money.”

Source: X

ETH rally fuelled by ‘hodl’er growth and social buzz

Ethereum has surged more than 50% since June 22, pushing prices to their highest levels since January. During the same period, the number of non empty ETH wallets climbed above 152 million, the largest count of any asset. On social media, discussions about ETH now make up 13% of all crypto chatter, a level not seen since May 2024.

Source: Santiment on X

This combination of rising wallet counts and renewed community interest shows that more people are holding and talking about ETH and reflect genuine adoption rather than fleeting speculation. Together, they suggest Ethereum’s rally has solid momentum behind it.

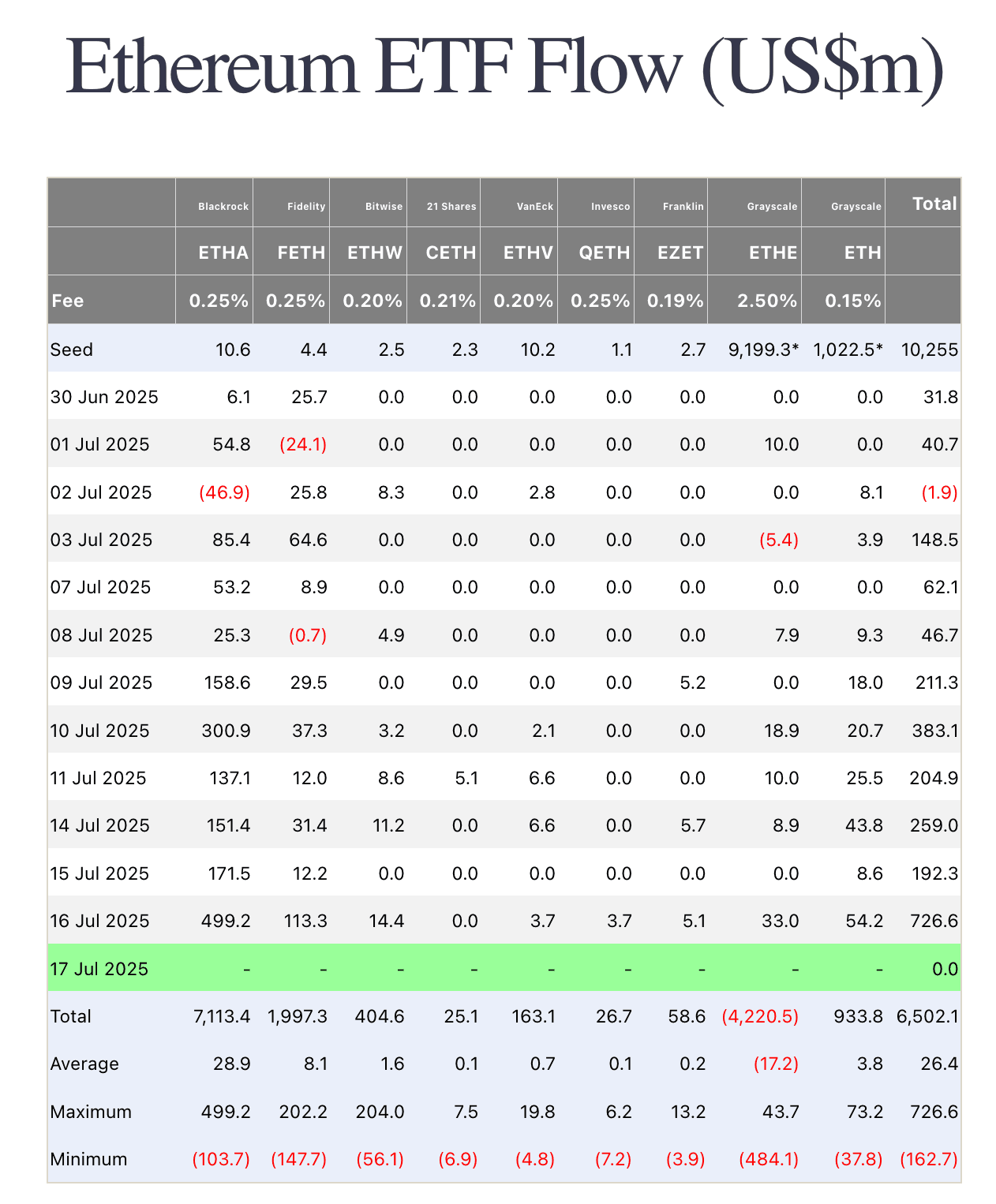

Institutional flows hit fever pitch

Spot Ethereum ETFs saw their largest single day inflows ever this Wednesday, with investors pouring $726 million into nine US listed funds. After a period of muted activity, fund inflows began picking up in late April and steadily gained steam through June. Over the past five trading days alone, these ETFs have attracted $1.8 billion in new capital, indicating a renewed shift in market sentiment as institutions and mainstream investors pile into Ethereum’s smart contract ecosystem.

Ethereum ETF Flow; Source: Farside Investors

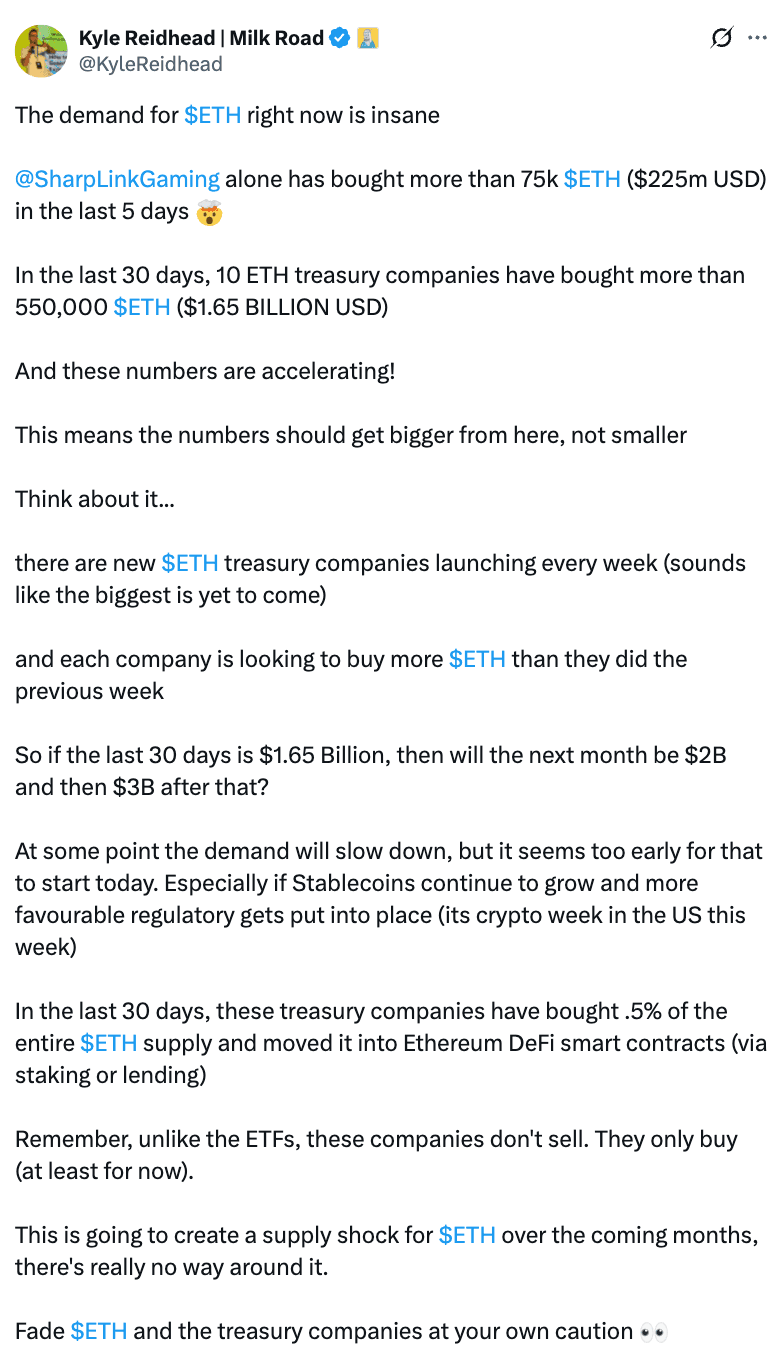

Companies snap up 550K ETH in treasury race

Over the past month, at least ten firms have scooped up 550,000 ETH in a growing trend of using ETH as a treasury asset. Inspired by MicroStrategy’s Bitcoin strategy, these companies are buying and holding ETH rather than selling, with accumulations rising each week. As Kyle Reidhead of Milk Road points out, this strategy is still in its early stages and could see $2 billion or more funnelled into ETH next month if current momentum holds.

Leading the pack is Sharplink Gaming, which added 75,000 ETH in just five days and now holds over 290,000 ETH. Other major players include Bitmine Immersion with 163,000 ETH and BitDigital with over 100,000 ETH. Dubbed “The League of Extraordinary ETH Accumulator Gentlemen,” these treasury teams are spurring each other on, turning accumulation into a friendly competition that underpins a strong narrative for long term ETH demand.

Source: Kyle Reidhead on X

Key takeaway

Ethereum’s break above $3,600 is underpinned by real demand—from whales moving ETH off exchanges into cold storage and staking, to over $1.8 billion in ETF inflows and $1.7 billion snapped up by treasury-minded firms.

Holder growth and social chatter confirm genuine adoption, while shrinking sell‑pressure and rising on‑chain activity set a firm foundation. With these forces converging, Ethereum looks well positioned to test the $3,800–$4,000 zone, driven by both smart‑money conviction and broadening mainstream interest.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 13th November, 2025 3:51 PM