HYPE of the masses

Hyperliquid, once flying under the radar, is now making headlines for the right reasons. Its native token, HYPE, has doubled in value over the past month, riding on the back of surging volumes, fresh user growth, and nearly $12 billion in open interest. With the team now in active dialogue with US regulators, what started as a niche DeFi derivatives platform is quickly turning into an ecosystem for the masses.

Today, we take a closer look at how Hyperliquid is now setting the tone for a new generation of decentralized trading.

Surging trading volume

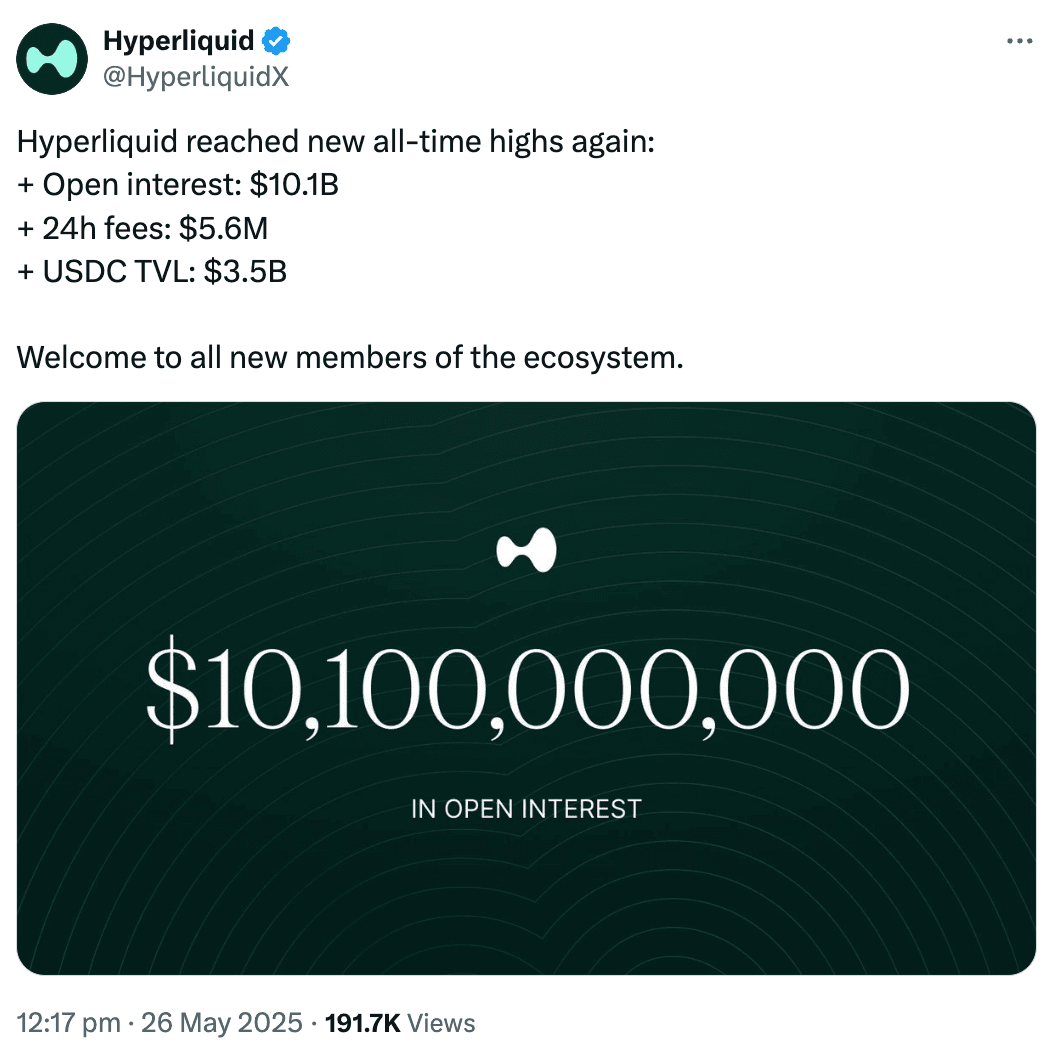

Hyperliquid’s total open interest recently crossed $10.1 billion, up 60% from earlier this month, as traders flocked to the platform during Bitcoin’s breakout. For context, that puts it in the same league as some of the largest centralized exchanges. Much of this was driven by high-stakes whales making bold leveraged bets on BTC and ETH. Top wallets like Machi Big Brother and James Wynn have been actively trading on the platform, using Hyperliquid's fast, on-chain execution and deep liquidity to move millions.

With over $3.5 billion in TVL, $5.6 million in daily fees, and a record 18,000 daily active addresses, the platform making waves among perps trading community.

Source: Hyperliquid on X

Hyperliquid opens the door to regulators

Earlier this week, Hyperliquid took a big step - it submitted two formal letters to the US Commodity Futures Trading Commission (CFTC), explaining how its platform works and why decentralized perpetuals deserve a seat at the table.

The team highlighted a few key points: trades are backed by on-chain collateral, users stay in control of their own funds (no middlemen), and positions are automatically liquidated if margins drop too low. In short, it’s a system built to reduce risk without needing centralized oversight.

By doing this, they’re hoping to show that DeFi platforms can be transparent, safe, and reliable—even without traditional oversight. Their bigger goal is to push for flexible, principle-based rules that support innovation while still protecting users.

Also read: Hyperliquid: Decoding the HYPE

$HYPE hit all time high this week

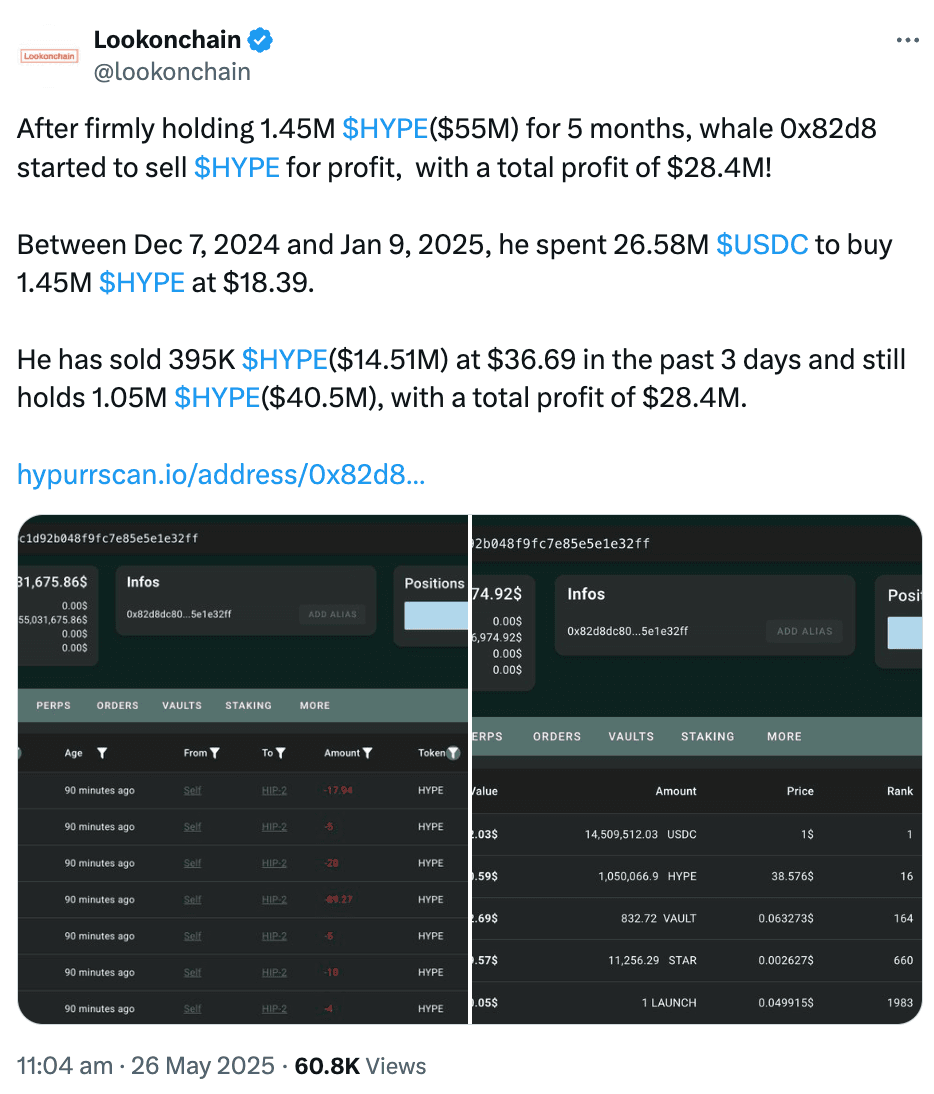

Hyperliquid’s price surged by over 27% this week and smashed a new ATH at $39.96 on May 26. Besides, its market capitalization briefly surpassed SUI to become one of the top crypto assets in the market. However, traders have begun to extract profits though the selling pressure is not expected to mount.

Along with a rise in the volume, the rise in whale accumulation has also contributed to the HYPE price rally. Earlier, a popular on-chain platform, Lookonchain, reported a whale selling 395,000 HYPE and earning a profit of over $28 million after holding the token for nearly five months. This could be the potential reason for the current pullback, but multiple reasons point towards a continued upswing. One of the major ones is the accumulation by other whales.

Source: Lookonchain on X

Tokenomics are doing heavy lifting

Hyperliquid’s native token HYPE isn’t just riding a wave of speculation - it’s being actively supported by the protocol’s own mechanics. Over the past seven months, Hyperliquid’s autonomous buyback engine has quietly bought back over $850 million worth of HYPE from the market, using 97% of platform revenue to do so. That buyback fund is now sitting on a healthy profit, creating real demand pressure by reducing supply day after day.

Meanwhile, whales are doubling down. In the past few days alone, multiple deep-pocketed wallets have accumulated millions of dollars’ worth of HYPE, with average entry prices now pushing above $38. These moves suggest growing conviction from large holders that the $HYPE still has room to run.

On-chain momentum confirms HYPE’s breakout

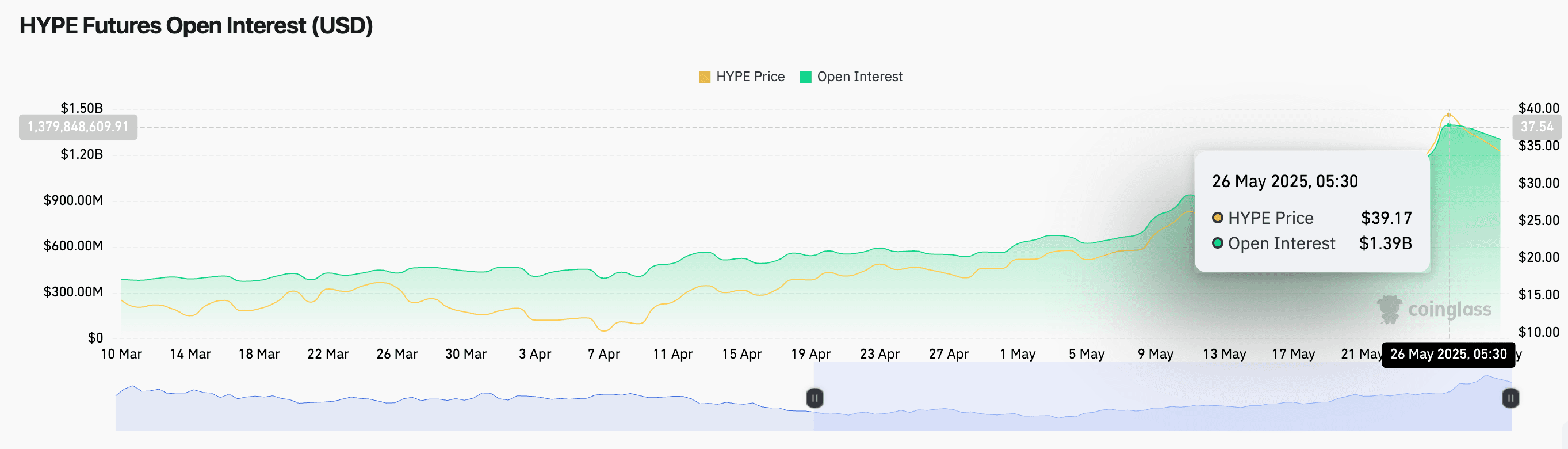

Hyperliquid’s on-chain strength is starting to show up across all the right metrics. Open interest in HYPE futures has surged to a new high of $1.39 billion, while total value locked (TVL) touched $1.46 billion this week - both clear signs that fresh capital is entering the ecosystem.

HYPE Futures Open Interest (USD); Source: Coinglass

Stablecoin market cap within the protocol also sits near $3.6 billion, pointing to strong liquidity and user activity. While volumes have cooled slightly, the uptick in TVL and stablecoin inflows suggests users are not just speculating - they’re actively participating in the ecosystem. All of this supports the idea that HYPE’s rally is being driven by more than just price momentum.

Key Takeaway: momentum built on participation and product strength

Hyperliquid’s recent growth has been driven by a combination of strong market participation, growing trust from high-volume traders, and healthy protocol mechanics. With nearly $12 billion in open interest, rising stablecoin inflows, and a buyback engine reinforcing token value, the platform is seeing clear signs of user conviction.

Add to that meaningful regulatory engagement and growing activity across the board, and it’s clear Hyperliquid is building staying power in a crowded DeFi landscape. The current momentum reflects both trader interest and structural strength; two things that often don’t arrive together.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 8th December, 2025 4:41 PM