Solana hits $200 again – what lies ahead?

Solana (SOL) surged yesterday, breaking back above the $200 mark for the first time since late July—a key psychological and technical milestone that has sparked renewed optimism across the altcoin market. Analysts note that reclaiming this level often draws in fresh buying interest, improving liquidity and setting the stage for potential upside continuation. Despite lagging behind Ethereum in recent weeks, SOL remains one of the few major assets, besides Bitcoin, to have already printed a new all-time high this cycle, underscoring its resilience and investor appeal.

This latest rally comes amid broader altcoin strength, with ETH above $4,700, XRP, BNB, DOGE, and ADA also posting strong double-digit or near double-digit gains. Fueling Solanaʼs momentum is a wave of crypto treasury accumulation, with public companies now holding nearly $675 million in SOL. With institutional inflows and corporate accumulation on the rise, we examine the key catalysts that could fuel Solanaʼs next leg of growth.

Solana ETF approval will be a major driver

The ETF narrative appears likely to play out this year. On Polymarket, odds of a Solana ETF launching in 2025 sit at 99%.

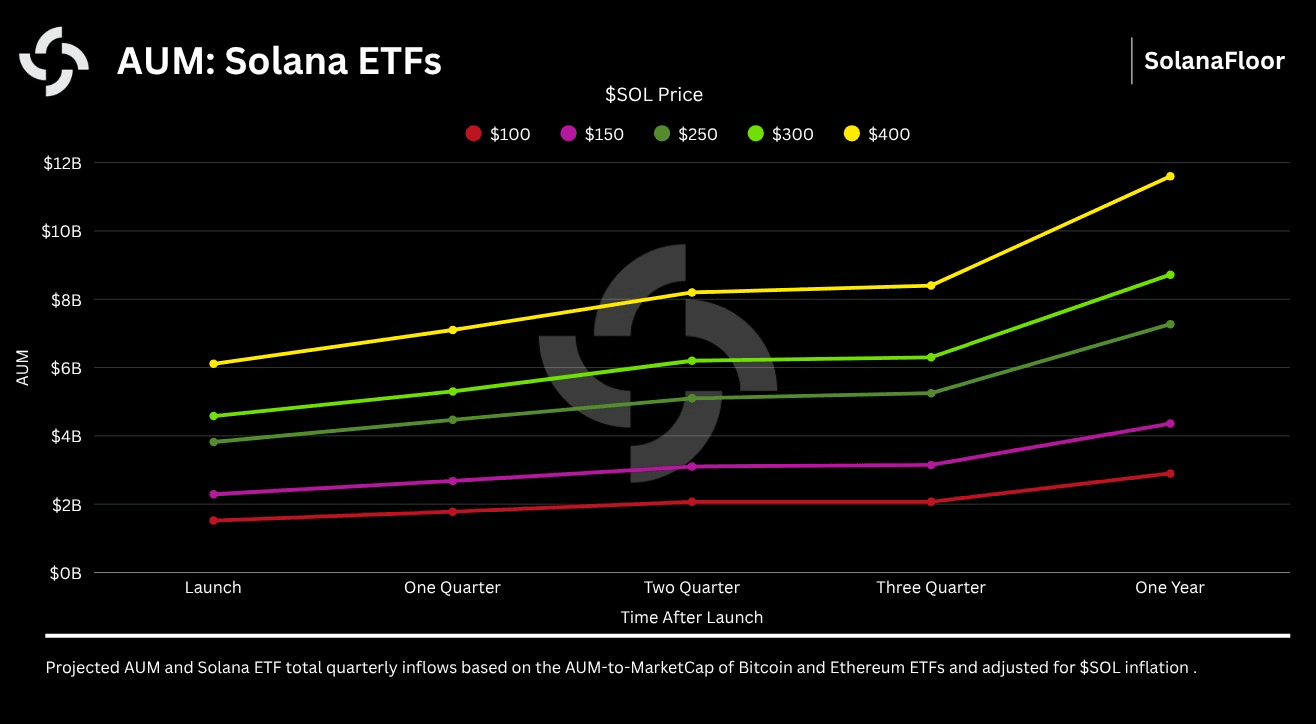

When Bitcoin ETFs went live in January 2024, they absorbed roughly 3.25% of BTC’s market cap within days, climbing to 5.8% after one year. Ethereum ETFs followed a similar pattern, starting at 2.41% of supply and reaching 4.57% in twelve months. By applying these historical AUM-to-market-cap ratios to Solana’s market size, analysts see strong potential for similar adoption.

Where Solana may have a unique edge is staking integration. Unlike Bitcoin or Ethereum at ETF launch, Solana offers a native staking yield, which could make ETF products more appealing to both retail and institutional investors seeking passive returns alongside price exposure. If approved, this could position SOL ETFs as one of the most attractive crypto investment vehicles in the market—accelerating institutional adoption and possibly tightening supply on exchanges.

Solana assets under management. Source: SolanaFloor

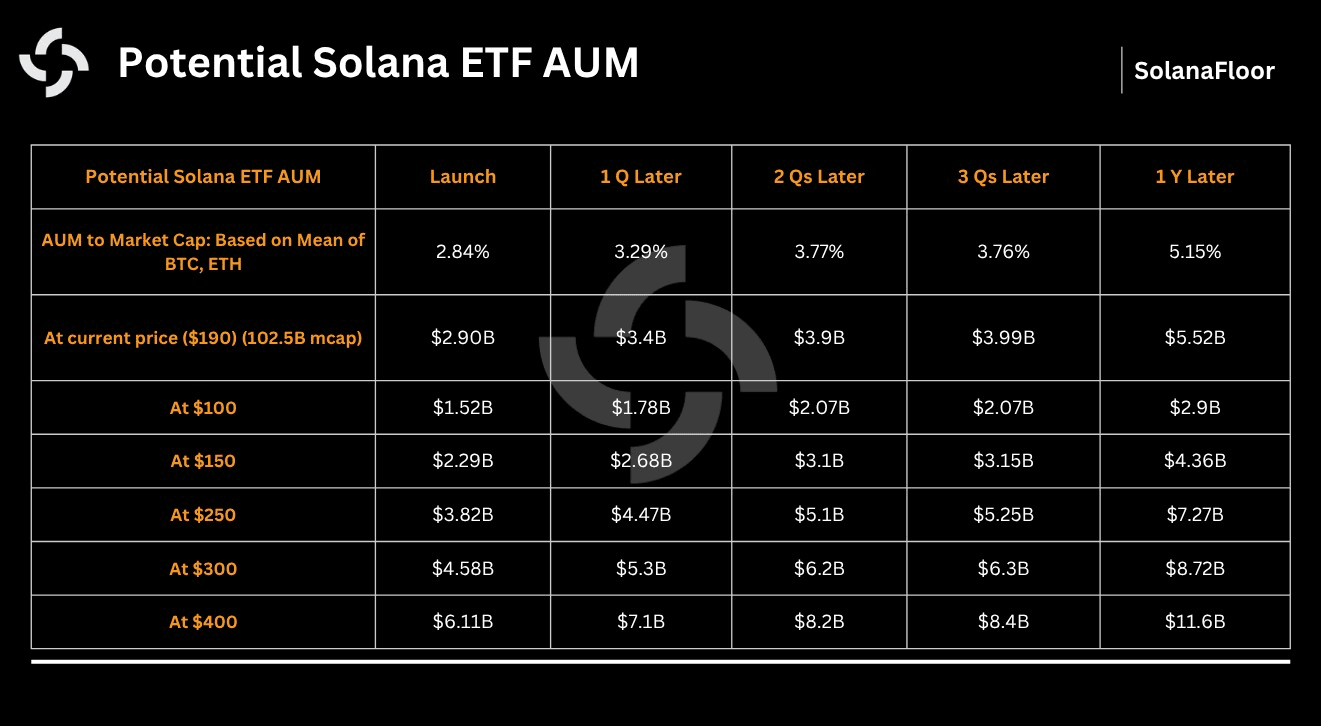

These ETFs could attract $5.5 billion in inflows

A new report estimates that US-listed Solana ETFs could attract approximately $2.9 billion in initial inflows, growing to $5.5 billion within the first year if approved, based on historical ETF performance metrics from Bitcoin and Ethereum. With filings already submitted by major issuers like Fidelity and Franklin Templeton, and an SEC review window closing around mid-October, the path to approval feels unusually clear.

If this plays out as expected, it would mirror the transformative impact Bitcoin and Ethereum ETFs had on institutional adoption—offering Solana a chance to step into broader investor portfolios. Given Solana’s high usage, staking yield edge, and network scalability, the ETF vehicle could significantly amplify capital inflows and elevate SOL’s market profile.

Solana AUM post ETF estimate. Source: SolanaFloor

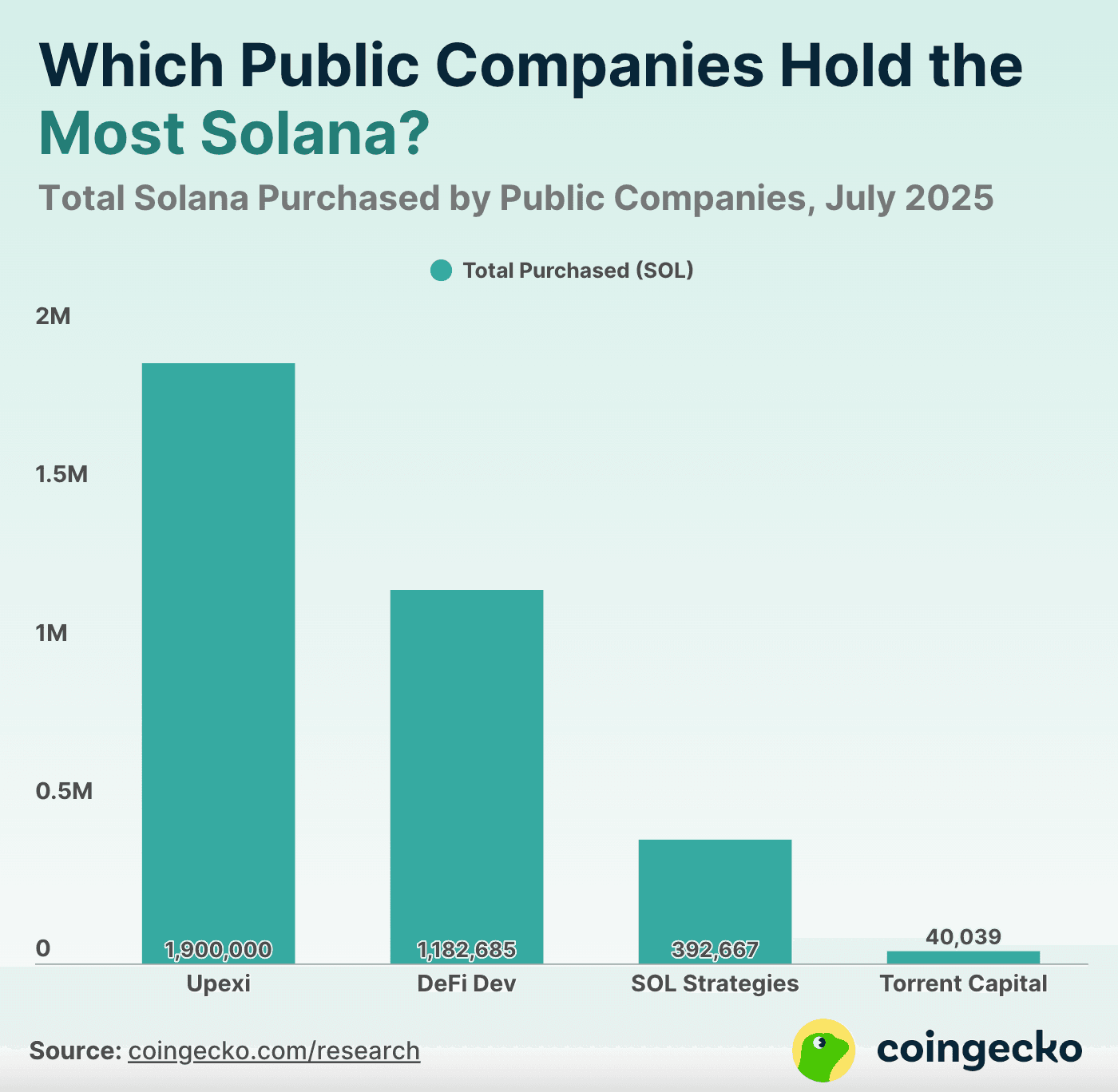

Institutional accumulation poised to fuel SOL’s next leg up

Institutional wallets are building sizeable, conviction-led positions. As of late July, Upexi Inc. leads the pack with 1.9 million SOL acquired at an average of $168.6. DeFi Developments Corp follows closely, holding 1.18 million SOL at an average of $137. Meanwhile, SOL Strategies controls 392,667 SOL purchased at $158 and Torrent Capital maintains a smaller but profitable stake of 40,039 SOL.

Collectively, these four firms own over 3.5 million SOL — roughly 0.65% of the circulating supply — with a combined market value north of $591 million. This growing presence of publicly listed companies on Solana’s cap table speaks volumes about rising institutional confidence. If more corporates earmark treasury allocations to SOL in the months ahead, the added demand could become a meaningful price catalyst, fuelling the next leg higher.

Solana holdings by public companies. Source: Coingecko

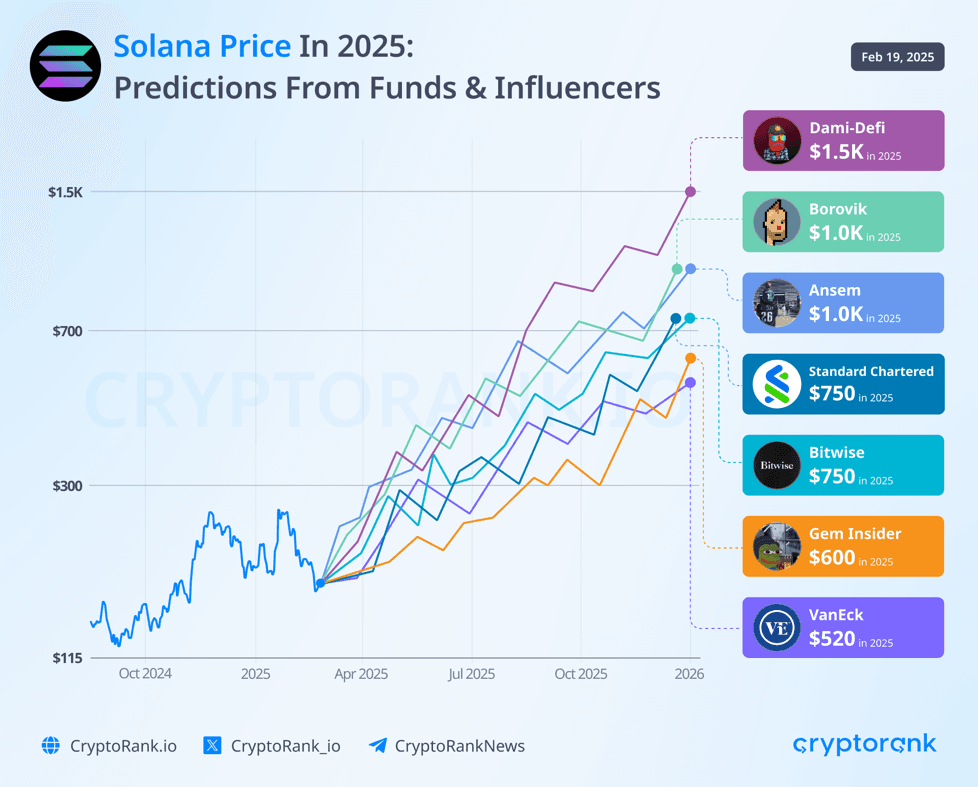

Social signals spike as analysts project massive upside

Solana has emerged as a central topic in crypto conversations, now accounting for 9% of total crypto discussions — the highest level since June. This level of engagement and technical optimism suggests that investor interest is switching into overdrive.

Near-term analysts are eyeing the $200–$300 range, highlighting breakout potential once resistance zones fall. More optimistic scenarios push the ceiling much higher, while conservative 2025 projections land between $315 and $450. With both technical patterns and social attention aligning, Solana’s momentum is gathering fuel from both chart watchers and the broader market narrative.

Solana price predictions for 2025. Source: Cryptorank

If meme season returns, Solana holds the crown

After a brief lull earlier this year, the meme coin frenzy is showing signs of life and if history is any guide, Solana stands at the center of the action. Mid-2025 has already seen a spike in meme token launches, surging DEX volumes on platforms like Pump.fun and relentless social chatter on X and Telegram. Solana’s unmatched transaction speed, negligible fees, and thriving retail trading culture make it the undisputed home turf for meme coin speculation. Pairing Solana’s ultra-fast throughput and low fees with Axiom Trade’s optimal RPC creates a powerhouse for meme coin trading. This combo lets traders snipe new launches instantly, move in and out of high-volume pairs without lag, and run lightning-fast automated bots giving Solana an undeniable edge in the meme coin arena.

Key Takeaway

Solana’s climb back above $200 clearly indicates its strength in a market where institutional conviction is deepening. With corporate treasuries now holding hundreds of millions in SOL and ETF approval odds hovering near certainty, the coming months could see a convergence of catalysts rarely aligned in crypto. A green light from the SEC would not only unlock billions in potential inflows but, thanks to Solana’s native staking yield, could offer one of the most compelling ETF propositions yet — blending price exposure with passive income in a way neither Bitcoin nor Ethereum could at launch. That combination could meaningfully tighten liquid supply on exchanges, amplifying any upside move.

Beyond the ETF narrative, Solana’s fundamentals continue to pull in retail and speculative flows, especially in niches where it dominates. The meme coin resurgence, rising DEX activity, and surging social chatter all point to a market that’s not just watching Solana, but actively positioning around it. If the macro backdrop stays supportive, the interplay of institutional accumulation, ETF-driven demand, and grassroots trading enthusiasm could set the stage for a powerful Q4 rally, with $300 no longer a stretch target but a realistic waypoint on the road ahead.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Please do your own research before investing and seek independent legal/financial advice if you are unsure about the investments.

Updated on: 14th August, 2025 4:00 PM